Inflation-Proofing Your Lifestyle

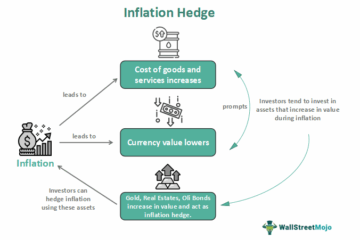

How to Protect Your Purchasing Power Over Time Inflation quietly erodes purchasing power. Prices rise, dollars buy less, and expenses that once felt manageable slowly…

How to Protect Your Purchasing Power Over Time Inflation quietly erodes purchasing power. Prices rise, dollars buy less, and expenses that once felt manageable slowly…

How Location Can Transform Your Finances Remote work has changed more than where we work—it has changed how we design our financial lives. For the…

How to Keep More of What You Earn Earning a high income in the United States is a major achievement—but it also comes with greater…

Building a Stronger Money Partnership Money is one of the most common sources of tension in relationships—but it can also be one of the strongest…

How to Protect and Grow Your Wealth Earning a high income in the United States creates opportunity—but it also creates complexity. As income rises, taxes…

How to Budget Smarter Where You Live Housing is the largest expense for most households in the United States. Whether you rent or own, where…

How to Use Debt Without Letting It Control Your Life Debt is a normal part of financial life in the United States. Mortgages, student loans,…

How to Protect Your Finances When Life Happens Financial emergencies don’t come with warnings. A job loss, medical bill, car repair, or unexpected move can…

How to Manage Money Through Every Phase of Life Personal finance isn’t static—your priorities, risks, and goals evolve as your life changes. What makes sense…

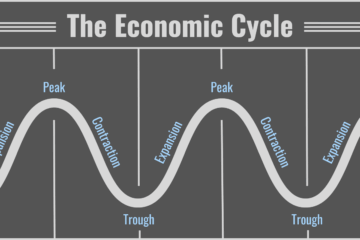

How They Impact Your Money Inflation, interest rates, and economic cycles affect everyone—whether you’re paying rent, saving money, investing, or carrying debt. While these concepts…