Taxes and Financial Planning for High Earners

How to Keep More of What You Earn

Earning a high income in the United States is a major achievement—but it also comes with greater financial complexity. As income increases, taxes often become the single largest expense, sometimes exceeding housing, lifestyle, or education costs.

Without a proactive strategy, high earners can lose a significant portion of their income to taxes simply by default. Smart tax planning isn’t about aggressive loopholes—it’s about using the tax system legally and intentionally to align your money with long-term goals.

In this article, you’ll learn:

- Tax strategies for high-income households

- How to reduce taxable income legally

- Advanced retirement contribution strategies

- Common tax planning mistakes high earners make

💼 Tax Strategies for High-Income Households

High-income households often face a more complex tax environment, including:

- Higher marginal federal tax rates

- Additional Medicare surtaxes

- State and local income taxes

- Phaseouts of deductions and credits

As income grows, reactive tax filing is no longer enough. High earners benefit most from year-round tax planning rather than last-minute decisions.

Core strategies commonly used:

- Maximizing tax-advantaged accounts

- Coordinating income timing and deductions

- Aligning investment strategy with tax efficiency

- Leveraging employer benefits strategically

- Working proactively with tax professionals

👉 The goal isn’t just minimizing this year’s tax bill—it’s optimizing lifetime tax efficiency.

💰 How to Reduce Taxable Income Legally

Common ways to reduce taxable income:

- Pre-tax retirement contributions (401(k), 403(b))

- Health Savings Accounts (HSAs), if eligible

- Flexible Spending Accounts (FSAs)

- Charitable contributions

- Tax-loss harvesting in taxable investment accounts

Strategic charitable giving

Instead of donating small amounts every year, some high earners use:

- Donor-advised funds (DAFs)

- Bundling multiple years of donations into high-income years

This approach increases deductions in peak earning years while allowing charitable support to continue over time.

👉 Reducing taxable income isn’t about giving things up—it’s about redirecting money intentionally.

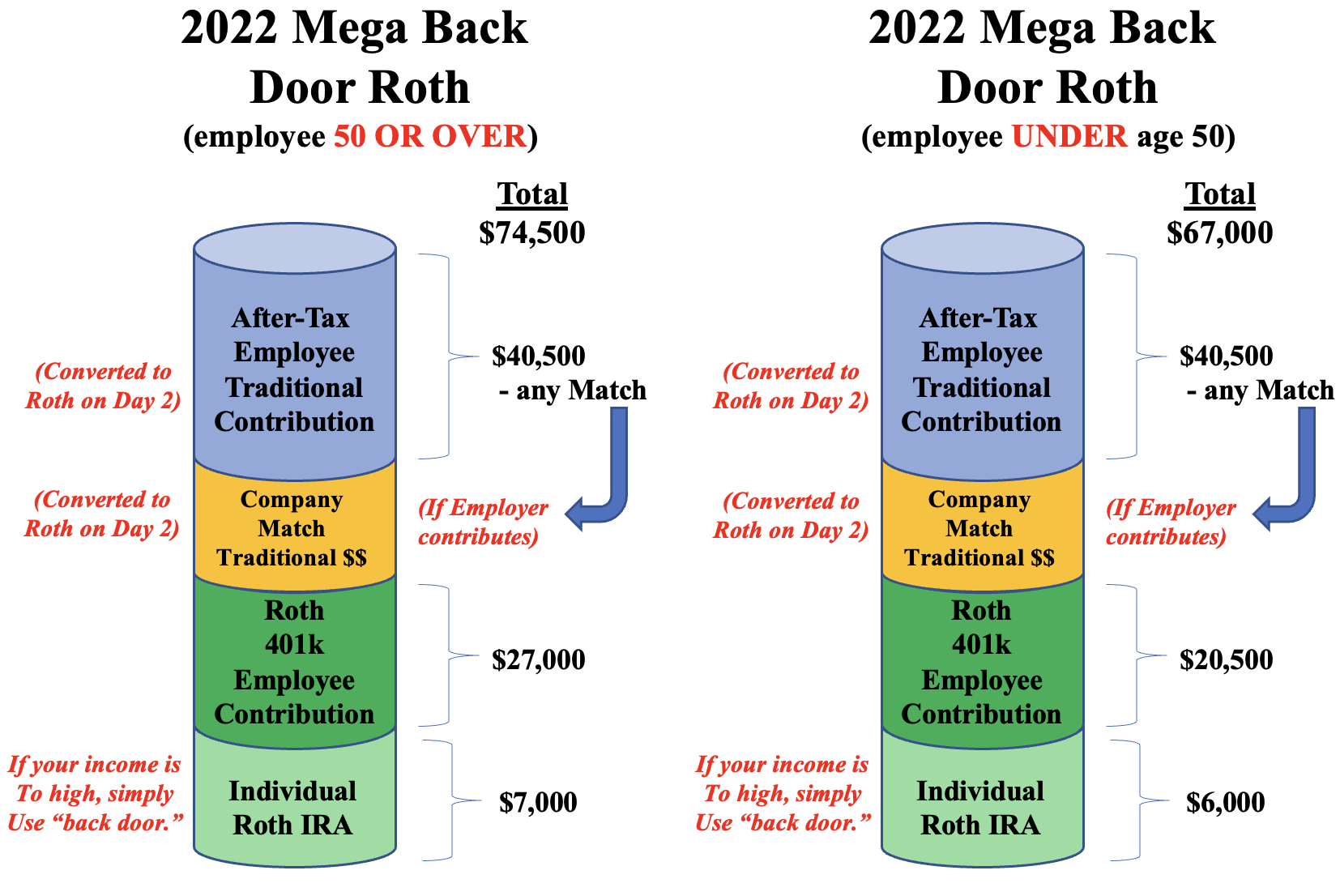

🧓 Advanced Retirement Contribution Strategies

Many high earners max out standard retirement accounts early in the year—but advanced strategies can unlock additional tax advantages.

Beyond traditional retirement limits:

- Backdoor Roth IRA – Enables Roth contributions despite income limits

- Mega Backdoor Roth – Uses after-tax 401(k) contributions (if the plan allows)

- Deferred compensation plans – Often available to executives

- Solo 401(k) or SEP IRA – Ideal for business owners and consultants

Why advanced strategies matter:

- Reduce current taxable income

- Create tax-free income in retirement

- Improve long-term compounding

- Increase flexibility in retirement withdrawals

👉 For high earners, retirement planning is less about access and more about precision and optimization.

⚠️ Common Tax Planning Mistakes High Earners Make

Ironically, many high earners overpay taxes—not because they lack resources, but because they lack coordination.

Common mistakes include:

❌ Waiting until tax season to plan

❌ Focusing only on income growth instead of tax efficiency

❌ Ignoring state and local tax exposure

❌ Missing surtaxes and deduction phaseouts

❌ Holding too many investments in taxable accounts

❌ Failing to align charitable giving with tax strategy

👉 Tax planning works best when it’s proactive, not reactive.

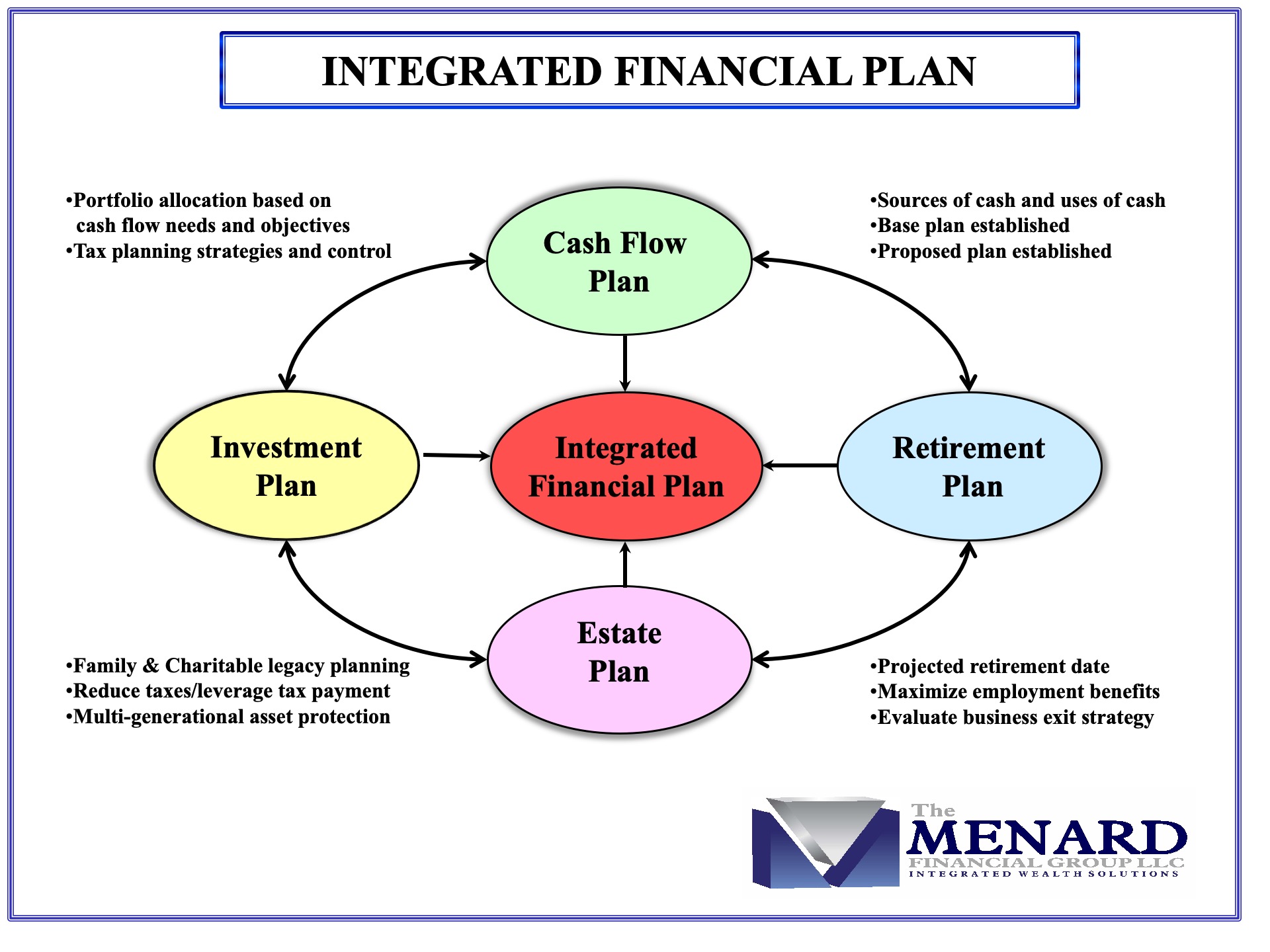

📊 Coordinating Taxes With Overall Financial Planning

Taxes should never be planned in isolation. The most effective strategies integrate:

- Investment allocation

- Retirement goals

- Cash flow planning

- Estate and legacy considerations

Real-world examples:

- A tax-efficient portfolio can outperform a tax-inefficient one—even with lower gross returns

- Strategic Roth conversions can reduce lifetime tax liability

- Coordinating income timing can smooth tax brackets across years

👉 True optimization comes from coordination, not complexity.

🧠 The Mindset Shift High Earners Need

As income rises, financial focus should evolve:

- From earning more → to keeping more

- From short-term savings → to long-term optimization

- From tax minimization → to lifetime tax strategy

This mindset shift often separates high income from lasting wealth.

✅ Final Thoughts

High income creates opportunity—but without smart tax and financial planning, it also creates inefficiency. By using legal tax-reduction strategies, maximizing advanced retirement contributions, and avoiding common planning mistakes, high earners can dramatically improve long-term outcomes.

Taxes are one of the few financial variables you can actively influence—but only with intentional planning.

For high earners, financial success isn’t just about what you make.

It’s about what you keep, grow, and protect.