Debt Management and Smart Borrowing

How to Use Debt Without Letting It Control Your Life

Advertising

Debt is a normal part of financial life in the United States. Mortgages, student loans, credit cards, and personal loans are widely used—and when managed correctly, debt can be a tool rather than a burden. When mismanaged, however, debt can quickly limit choices, increase stress, and delay long-term goals.

Smart borrowing isn’t about avoiding debt at all costs. It’s about understanding how debt works, prioritizing repayment wisely, and using credit intentionally.

In this article, you’ll learn:

The difference between good debt and bad debt

How to prioritize debt repayment

Personal loans vs. credit cards

When debt consolidation makes sense

⚖️ Good Debt vs. Bad Debt

Not all debt is created equal. One of the most important steps in managing debt is understanding which types help you build wealth and which ones hold you back.

What is good debt?

“Good debt” generally refers to debt that:

Has relatively low interest rates

Helps increase income or net worth

Supports long-term financial goals

Examples include:

Mortgages (building home equity)

Student loans (when tied to higher earning potential)

Business loans (used to grow income)

Good debt still requires careful management, but it can create long-term value.

Also check out: Emergency Funds and Financial Resilience

What is bad debt?

“Bad debt” usually:

- Carries high interest rates

- Funds depreciating items

- Provides short-term pleasure with long-term cost

Examples include:

- High-interest credit card balances

- Payday loans

- Financing lifestyle purchases without a repayment plan

👉 The key difference isn’t just the type of debt—it’s whether the debt improves or weakens your financial future.

📊 How to Prioritize Debt Repayment

When juggling multiple debts, having a clear repayment strategy prevents overwhelm and saves money.

Step 1: List all debts

Include:

- Balance

- Interest rate

- Minimum payment

- Due date

- Clarity is empowering.

Step 2: Choose a repayment strategy

The Debt Avalanche Method

Focus on paying off the highest-interest debt first

Saves the most money over time

Mathematically optimal

The Debt Snowball Method

- Focus on paying off the smallest balance first

- Builds momentum and motivation

- Often easier to stick with

👉 The best method is the one you’ll follow consistently.

Step 3: Avoid new debt

Debt repayment only works if balances stop growing. Reduce discretionary spending and avoid using credit cards while paying down existing balances.

💳 Personal Loans vs. Credit Cards

Choosing the right borrowing tool can significantly affect how much interest you pay—and how fast you get out of debt.

Credit Cards

Pros:

- Flexible spending

- Rewards and protections

- Useful for short-term cash flow

Cons:

- High interest rates (often 18–30%)

- Easy to overspend

- Minimum payments can stretch debt for years

Credit cards are best when:

You can pay the balance in full every month

The expense is temporary and planned

Personal Loans

Pros:

Lower interest rates than credit cards

Fixed monthly payments

Clear payoff timeline

Cons:

Origination fees may apply

Requires good credit for best rates

Personal loans are often better for:

- Consolidating high-interest credit card debt

- Large, planned expenses with a repayment plan

👉 The goal isn’t borrowing—it’s borrowing with control and clarity.

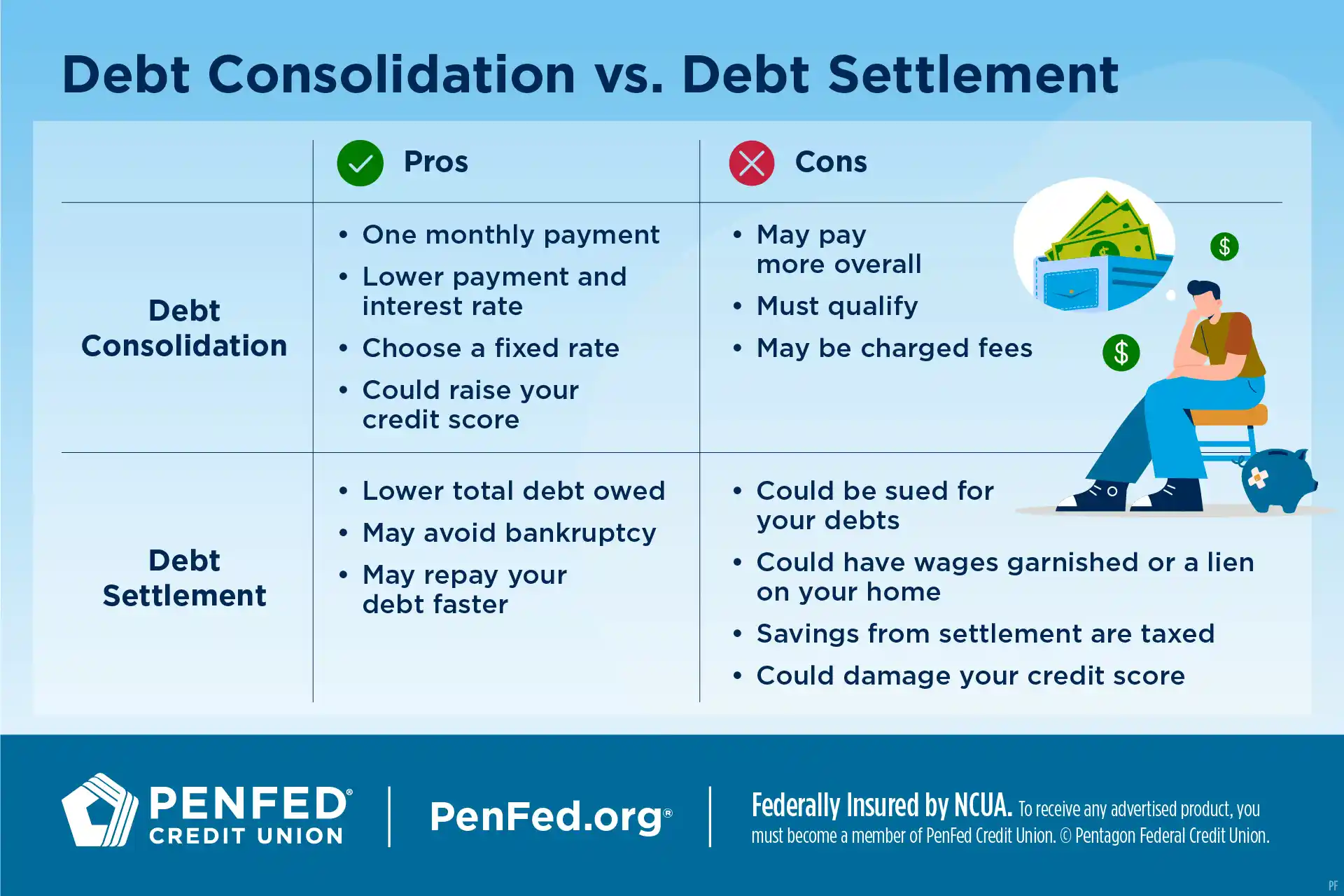

🔁 When Debt Consolidation Makes Sense

Debt consolidation combines multiple debts into a single loan or payment, often with a lower interest rate.

Debt consolidation may make sense if:

You qualify for a lower interest rate

- You’re overwhelmed by multiple due dates

- You commit to not accumulating new debt

- You understand the full cost of the new loan

Common consolidation options:

- Personal consolidation loans

- Balance transfer credit cards (0% introductory APR)

- Home equity loans (with caution)

When consolidation does NOT help

- If spending habits don’t change

- If fees outweigh interest savings

- If it increases repayment time significantly

👉 Consolidation is a tool, not a solution. Behavior change is what makes it work.

🧠 Smart Borrowing Habits That Protect Your Future

Healthy debt management isn’t just about numbers—it’s about habits.

Smart borrowing principles:

- Borrow only with a clear purpose

- Understand the true cost of interest

- Match debt length to the life of the purchase

- Always have a repayment plan

- Avoid borrowing to support lifestyle inflation

👉 Borrowing should support your goals—not delay them.

🛡️ Debt Management and Financial Stability

High debt limits flexibility. It affects:

- Your ability to save and invest

- Career and lifestyle choices

- Stress levels and mental health

Managing debt effectively:

- Improves cash flow

- Strengthens credit scores

- Increases financial resilience

- Accelerates long-term wealth building

👉 Reducing debt isn’t about deprivation—it’s about freedom.

✅ Final Thoughts

Debt is neither good nor bad—it’s how you use it that matters. By understanding the difference between productive and harmful debt, prioritizing repayment strategically, choosing the right borrowing tools, and knowing when consolidation makes sense, you can take control of your financial life.

Smart debt management creates options. And financial options create freedom.

Whether you’re paying off existing debt or borrowing for a future goal, clarity and intention are your most powerful tools.