Financial Planning for Couples and Shared Finances

Building a Stronger Money Partnership

Advertising

Money is one of the most common sources of tension in relationships—but it can also be one of the strongest tools for building trust and long-term stability. In the United States, where financial systems are individual-focused but life decisions are often shared, couples must learn how to manage money together intentionally.

Whether you’re dating seriously, living together, married, or navigating a separation, financial planning as a couple requires communication, structure, and flexibility.

- In this article, you’ll learn:

- The pros and cons of joint vs. separate bank accounts

- How to budget effectively as a couple

- How to talk about money in relationships

- How to plan finances for marriage and divorce

🏦 Joint vs. Separate Bank Accounts

One of the first financial decisions couples face is whether to combine finances—or keep them separate.

Joint bank accounts

Pros:

- Simplicity in paying shared bills

- Transparency and shared responsibility

- Easier tracking of household expenses

Cons:

- Less financial independence

- Requires strong trust and communication

- Can create tension if spending habits differ

Joint accounts work well for:

- Rent or mortgage

- Utilities

- Groceries and household expenses

Separate bank accounts

Pros:

- Financial autonomy

- Clear ownership of personal spending

- Fewer conflicts over discretionary purchases

Cons:

- More complex bill management

- Requires coordination and tracking

A hybrid approach (most common)

Many U.S. couples use:

- One joint account for shared expenses

- Separate personal accounts for individual spending

👉 There’s no “right” choice—only what fits your relationship, values, and lifestyle.

📊 Budgeting as a Couple

Budgeting as a couple isn’t just about numbers—it’s about alignment.

Step 1: Define shared financial goals

Examples:

- Paying off debt

- Saving for a home

- Building an emergency fund

- Planning for children or travel

Shared goals create motivation and reduce conflict.

Step 2: Decide how to split expenses

Common approaches include:

- 50/50 split

- Proportional to income (e.g., each partner pays based on earnings)

👉 Proportional splitting often feels fairer when incomes differ significantly.

Step 3: Build flexibility into the budget

- Include fun and discretionary spending

- Allow room for individual priorities

- Review the budget monthly

👉 A budget that feels restrictive won’t last.

💬 How to Talk About Money in Relationships

Avoiding money conversations doesn’t prevent conflict—it delays it.

Tips for healthy financial communication:

- Talk about money regularly, not only during stress

- Be honest about debt, income, and goals

- Avoid blame or judgment

- Focus on solutions, not past mistakes

- Respect different money backgrounds and beliefs

Important topics to discuss:

- Spending habits

- Debt and credit scores

- Savings and investing priorities

- Risk tolerance

- Financial values

👉 Financial compatibility isn’t about having the same habits—it’s about being able to work through differences.

💍 Planning Finances for Marriage

Marriage combines lives—and often finances. Planning ahead prevents misunderstandings later.

Key financial steps before or after marriage:

- Disclose all assets, debts, and credit scores

- Decide how accounts will be structured

- Align on financial goals and timelines

- Update beneficiaries and insurance policies

- Consider a prenuptial agreement, especially when assets or businesses are involved

👉 Planning isn’t pessimistic—it’s protective.

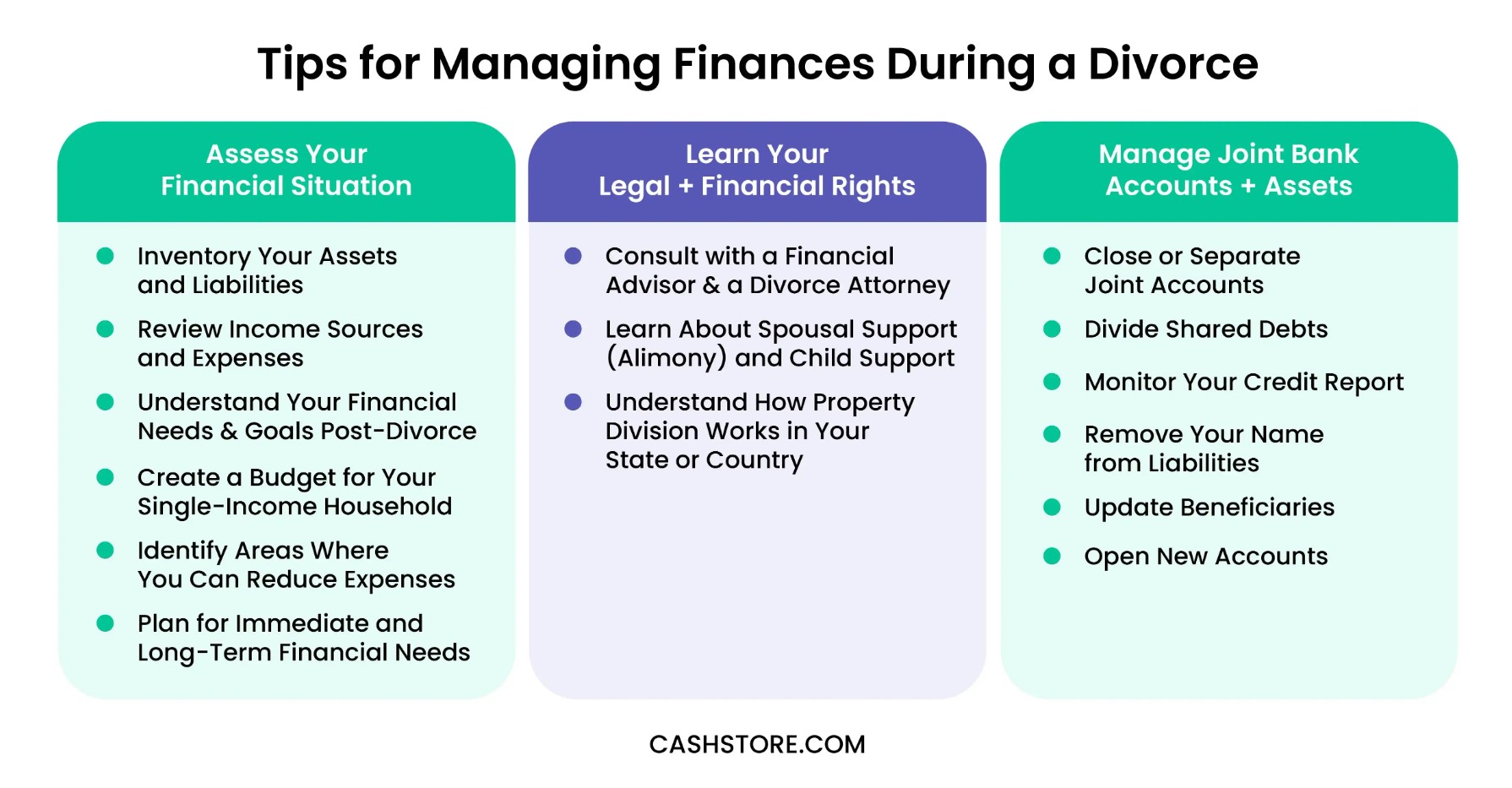

⚖️ Planning Finances for Divorce or Separation

While difficult, financial planning during divorce is essential for stability and recovery.

Key financial considerations:

- Separate bank accounts early

- Understand joint debts and liabilities

- Review credit reports

- Update beneficiaries and legal documents

- Build an independent emergency fund

- Divorce can significantly affect:

- Cash flow

- Housing costs

- Retirement savings

- Taxes

👉 Professional guidance from financial planners or attorneys can be invaluable during this transition.

🧠 Shared Finances and Long-Term Relationship Health

Healthy financial partnerships are built on:

- Transparency

- Mutual respect

- Ongoing communication

- Shared responsibility

Couples who manage money intentionally are more likely to:

- Avoid chronic financial stress

- Recover faster from setbacks

- Stay aligned through life changes

- Build long-term wealth together

👉 Money won’t make or break a relationship—but how you handle it together might.

✅ Final Thoughts

Financial planning for couples isn’t about control or perfection—it’s about partnership. By choosing the right account structure, building a shared budget, communicating openly about money, and planning for both beginnings and endings, couples can reduce stress and strengthen their relationship.

Money is one of the few areas where small, intentional decisions can have a massive long-term impact—not just on finances, but on trust and connection.

Strong relationships and strong finances grow the same way: with honesty, consistency, and shared purpose.