Remote Work, Relocation, and Cost-of-Living Arbitrage

How Location Can Transform Your Finances

Advertising

Remote work has changed more than where we work—it has changed how we design our financial lives. For the first time, millions of Americans can earn income tied to high-cost job markets while living in lower-cost locations. This shift has made cost-of-living arbitrage one of the most powerful—and underused—financial strategies available today.

Relocating strategically can increase savings, reduce stress, and accelerate long-term wealth building without changing your income.

In this article, you’ll learn:

- The financial benefits of remote work

- How moving to lower-cost states can improve your finances

- The tax implications of relocation

- How to budget for interstate or international moves

💻 Financial Benefits of Remote Work

Remote work offers more than flexibility—it creates measurable financial advantages.

Key financial benefits:

- Lower commuting costs (gas, parking, public transit)

- Reduced housing pressure—no need to live near offices

- Lower daily expenses (meals, clothing, childcare logistics)

- Greater control over lifestyle choices

For many workers, remote work can free up thousands of dollars per year, even without a raise.

👉 The real financial power of remote work lies in location flexibility.

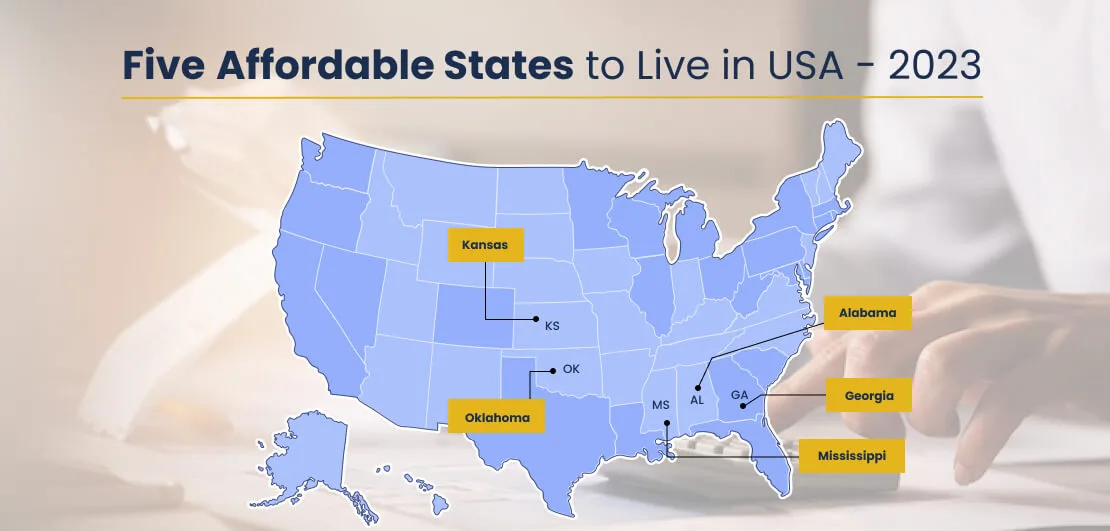

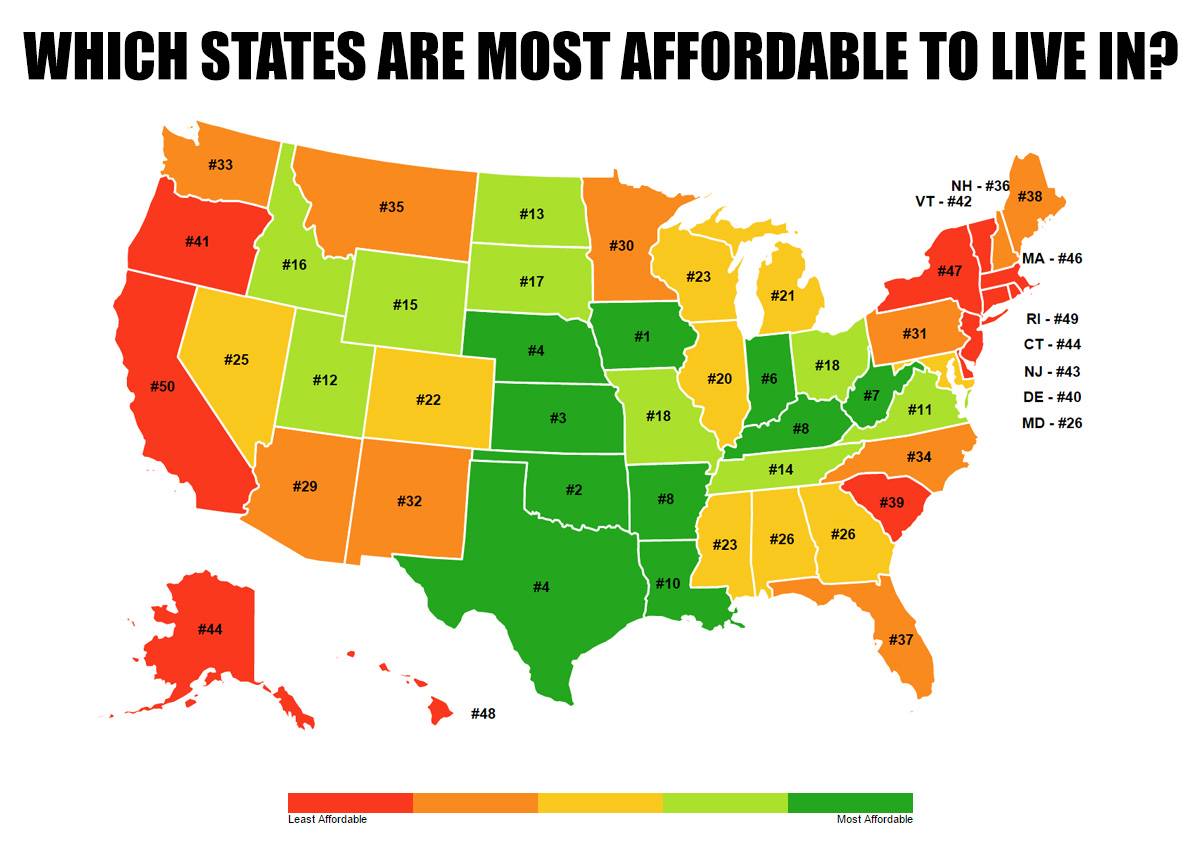

🏡 Moving to Lower-Cost States

Cost-of-living arbitrage means earning income in a high-pay market while living in a lower-cost area.

Examples of cost differences:

- Housing costs can vary by 2–3x between states

- Property taxes and insurance vary widely

- Utilities, groceries, and services are often cheaper outside major metros

States often chosen for affordability:

- Lower or no state income tax

- Affordable housing markets

- Growing infrastructure for remote workers

Financial benefits of relocating:

- Higher savings rate without income change

- Faster debt payoff

- Increased investing capacity

- Greater financial resilience

👉 Where you live can matter more than how much you earn.

🧾 Tax Implications of Relocation

Relocation doesn’t just change expenses—it can also significantly affect tax obligations.

Key tax considerations when moving:

- State income tax rates (some states have none)

- Residency rules—where you officially live matters

- Employer nexus rules—some employers adjust payroll taxes by state

- Local taxes in cities or counties

Important planning tips:

- Confirm how your employer handles multi-state employment

- Understand residency requirements before moving

- Keep documentation of your primary residence

- Consult a tax professional if moving mid-year

👉 Tax savings can amplify the financial benefits of relocation—but mistakes can erase them.

📦 Budgeting for Interstate or International Moves

Moving costs are often underestimated—and can temporarily offset savings if not planned carefully.

Common moving expenses:

- Movers or shipping costs

- Travel and temporary housing

- Security deposits or down payments

- Utility setup fees

- Furniture replacement

- Storage costs

Budgeting tips:

- Get multiple moving quotes

- Build a relocation fund in advance

- Separate one-time costs from ongoing savings

- Plan for 3–6 months of adjustment expenses

For international moves, also consider:

- Visa or legal fees

- Currency exchange costs

- Health insurance transitions

- Tax filing requirements

👉 A well-planned move pays for itself faster.

📊 Cost-of-Living Arbitrage in Action

Cost-of-living arbitrage works best when paired with intentional financial planning.

Common outcomes of successful arbitrage:

- Housing costs drop from 40% → 25% of income

- Emergency funds fill faster

- Retirement contributions increase

- Financial stress decreases

Some people use arbitrage to:

- Reach financial independence faster

- Transition to part-time work

- Fund business or investment goals

- Improve quality of life without income sacrifice

👉 Arbitrage isn’t about frugality—it’s about efficiency.

🧠 Lifestyle, Career, and Long-Term Considerations

Relocation decisions should balance finances with lifestyle.

Questions to ask before moving:

- Does this location support my career long term?

- What are healthcare and education options?

- How will community and social life change?

- Is the move reversible if needed?

👉 Financial optimization should support life satisfaction—not replace it.

🛡️ Building Financial Resilience Through Flexibility

Remote work and location flexibility increase financial resilience by:

- Reducing fixed expenses

- Expanding job opportunities

- Allowing faster adjustment to economic changes

- Creating geographic optionality

In uncertain economic environments, flexibility becomes a financial asset.

✅ Final Thoughts

Remote work has turned geography into a financial lever. By combining remote income with smart relocation decisions, individuals and families can dramatically improve savings, reduce stress, and accelerate long-term goals.

Cost-of-living arbitrage isn’t about chasing the cheapest place to live—it’s about finding the right balance between income, expenses, taxes, and lifestyle.

Where you live is one of the few financial decisions that can reshape your entire budget overnight.

When used intentionally, location flexibility isn’t just convenient—it’s financially transformative.