Inflation, Interest Rates, and Economic Cycles

How They Impact Your Money

Advertising

Inflation, interest rates, and economic cycles affect everyone—whether you’re paying rent, saving money, investing, or carrying debt. While these concepts may sound abstract, they directly influence your purchasing power, borrowing costs, and financial security.

Understanding how these forces work helps you make smarter financial decisions in both good times and bad.

In this article, you’ll learn:

- How inflation affects everyday finances

- What interest rate changes mean for borrowers and savers

- How to protect your money during inflation

- Personal finance strategies for economic downturns

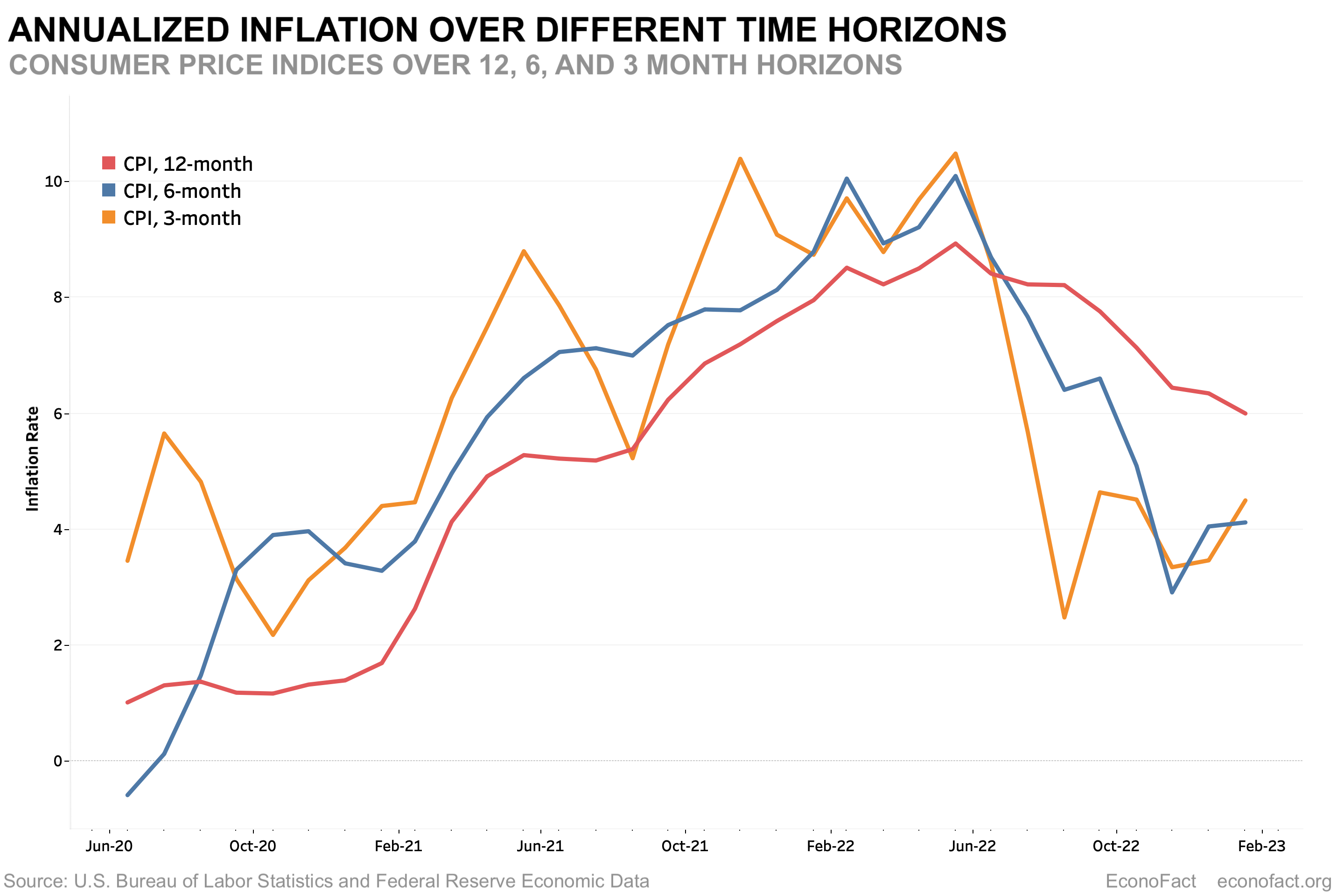

📈 How Inflation Affects Everyday Finances

Inflation is the gradual increase in prices over time. When inflation rises, your money buys less than it used to.

Everyday effects of inflation:

- Higher grocery and gas prices

- Increased rent and housing costs

- Rising healthcare and insurance expenses

- More expensive travel and services

If wages don’t increase at the same pace as inflation, households experience a decline in real purchasing power.

👉 Inflation isn’t just an economic concept—it shows up in your monthly budget.

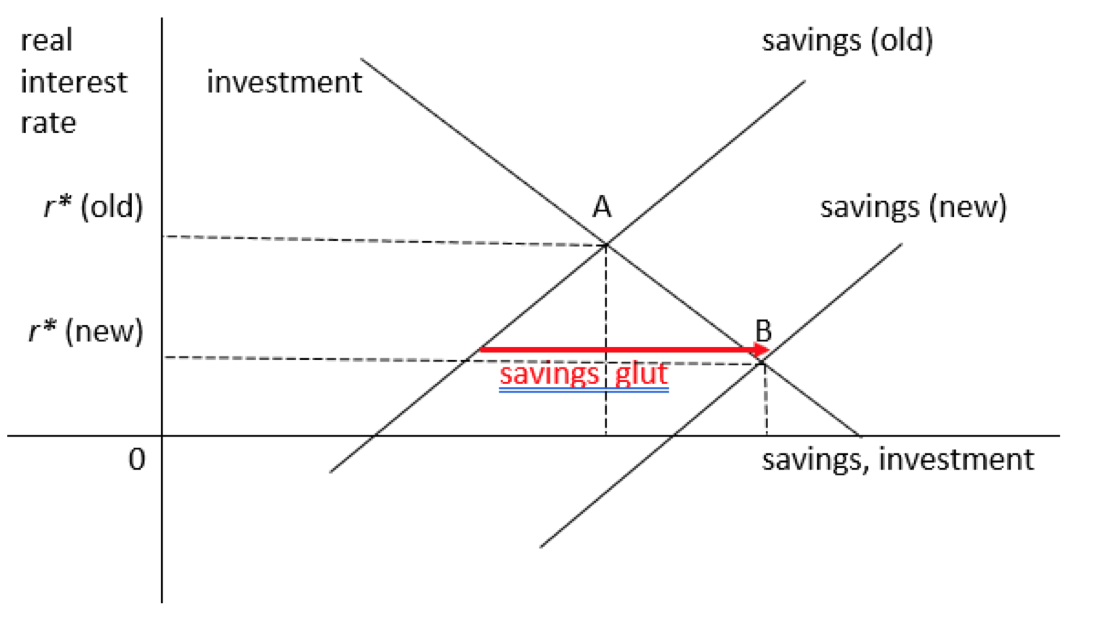

💸 What Interest Rate Changes Mean for Borrowers and Savers

Interest rates influence how expensive it is to borrow money—and how much you earn on savings.

When interest rates rise:

Borrowers:

- Higher mortgage, auto loan, and credit card costs

- More expensive refinancing

- Slower borrowing activity

Savers:

- Higher yields on savings accounts and CDs

- Better returns on conservative investments

When interest rates fall:

- Borrowing becomes cheaper

- Savings yields decrease

👉 Interest rate cycles reward different behaviors at different times.

Also read: Credit Cards, Rewards, and Points Strategy

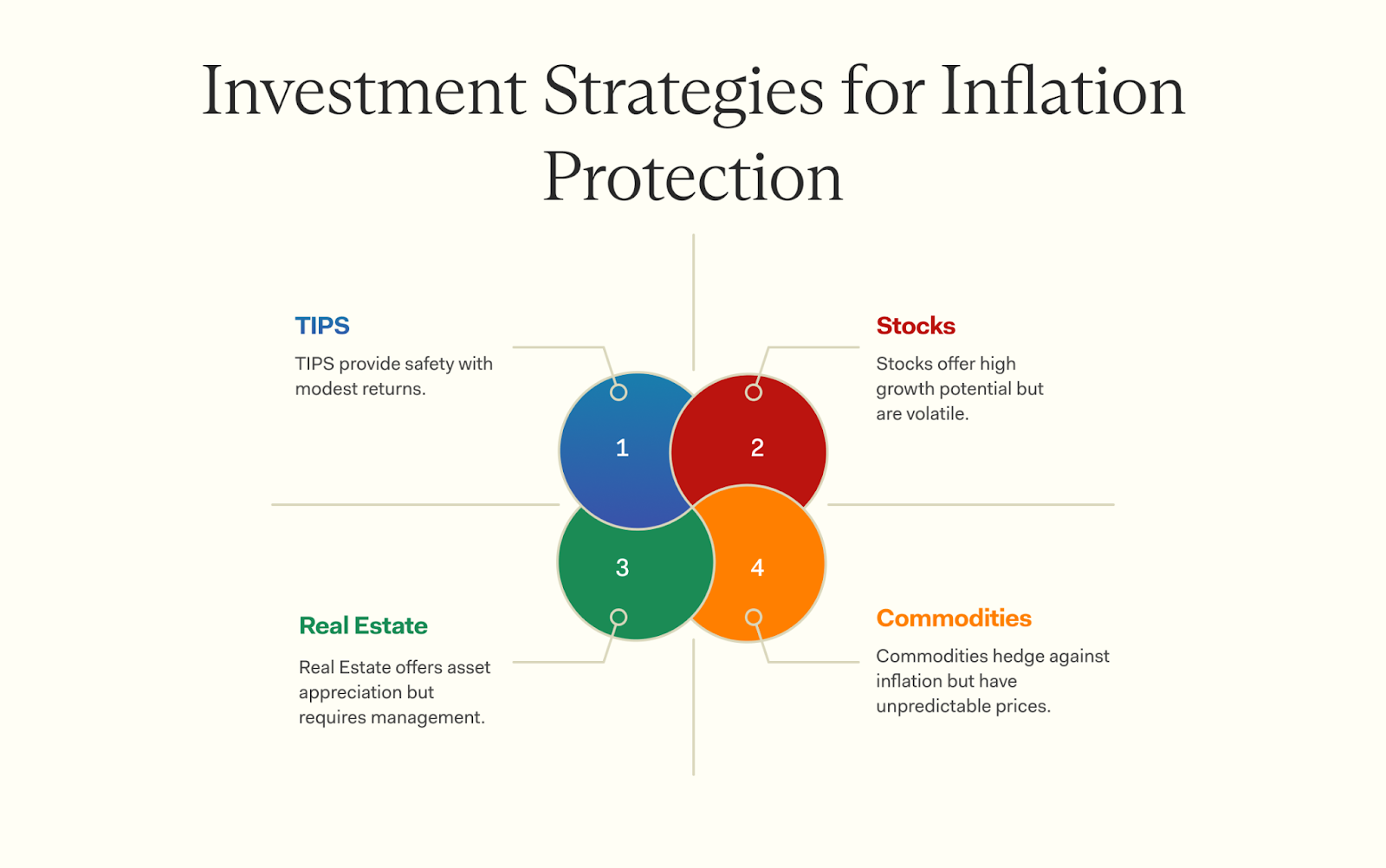

🛡️ How to Protect Your Money During Inflation

While inflation can’t be avoided, its impact can be managed with smart strategies.

Ways to protect your finances:

- Invest in assets that historically outpace inflation

- Use high-yield savings accounts for short-term cash

- Avoid holding excessive cash long term

- Focus on increasing income alongside investing

- Review and adjust your budget regularly

👉 Long-term investing has historically been one of the most effective inflation defenses.

🔄 Personal Finance Strategies in Economic Downturns

Economic downturns are a normal part of financial cycles. Preparation makes them far less damaging.

Smart downturn strategies:

- Strengthen your emergency fund

- Reduce high-interest debt

- Maintain diversified investments

- Avoid panic selling during market drops

- Focus on job stability and skill development

👉 Financial resilience matters more than prediction.

✅ Final Thoughts

Inflation, interest rates, and economic cycles are unavoidable—but they don’t have to derail your financial progress. By understanding how these forces affect your money and adjusting your strategy accordingly, you can protect your finances and stay on track toward long-term goals.

The key is adaptability: financial plans should evolve as economic conditions change.