Investing for Beginners and First-Time Investors

A Simple Guide to Getting Started

Advertising

Investing is one of the most effective ways to build wealth over time—but for beginners, it can feel overwhelming. The good news is that you don’t need a lot of money or advanced knowledge to start investing in the United States.

This guide will walk you through:

- How to start investing with little money

- Understanding risk and diversification

- Beginner-friendly investment portfolios

- Common investing mistakes to avoid

💵 How to Start Investing With Little Money

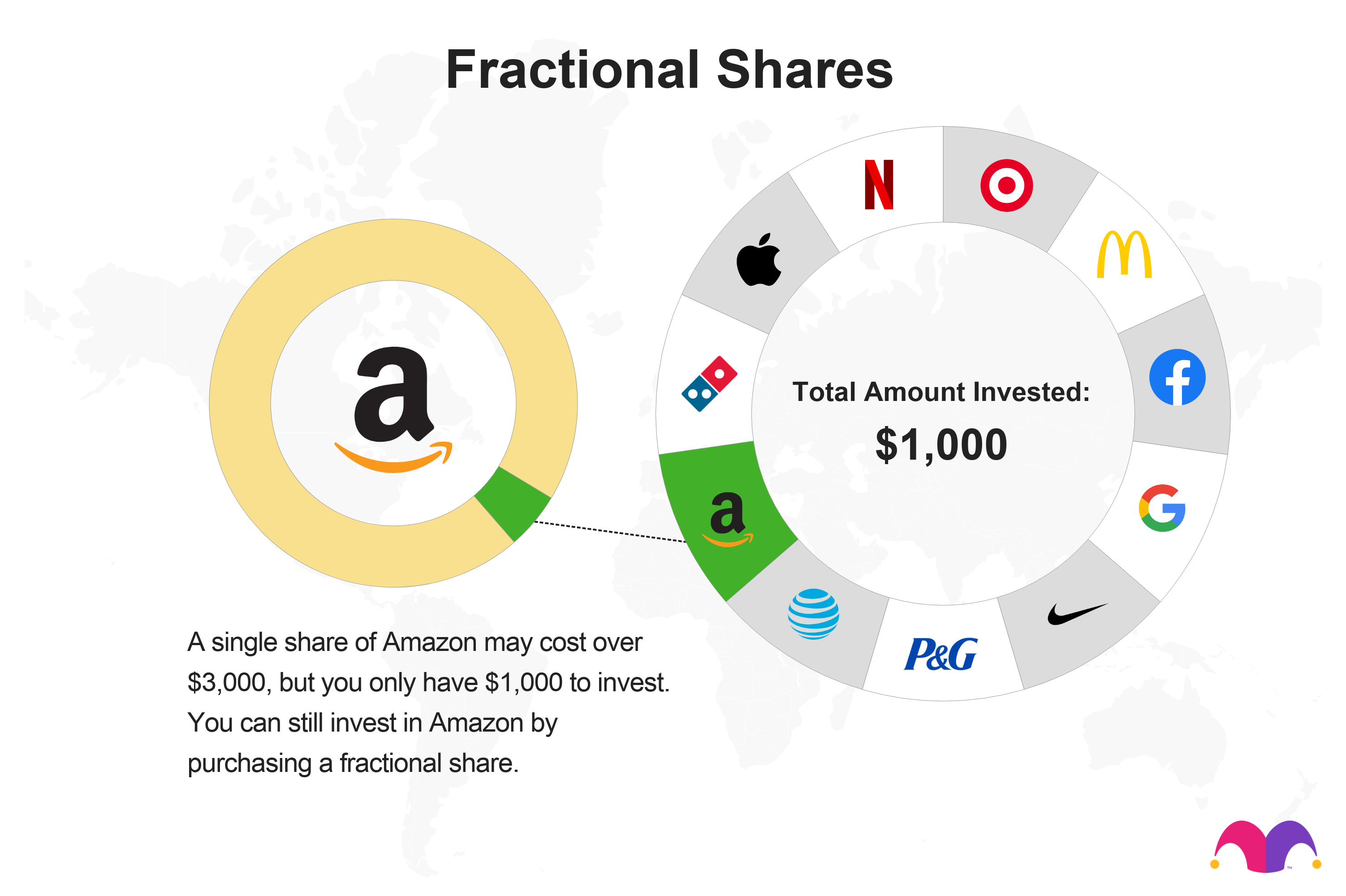

Many first-time investors believe they need thousands of dollars to begin. In reality, investing today is more accessible than ever.

Ways beginners can start:

- Fractional shares – Invest in stocks or ETFs with as little as $1

- Index funds and ETFs – Low-cost, diversified investments

- Employer-sponsored plans – Start with a 401(k), especially if there’s a company match

- Roth IRA – Ideal for long-term, tax-free growth

👉 The most important step isn’t how much you invest—it’s starting early and investing consistently.

⚖️ Understanding Risk and Diversification

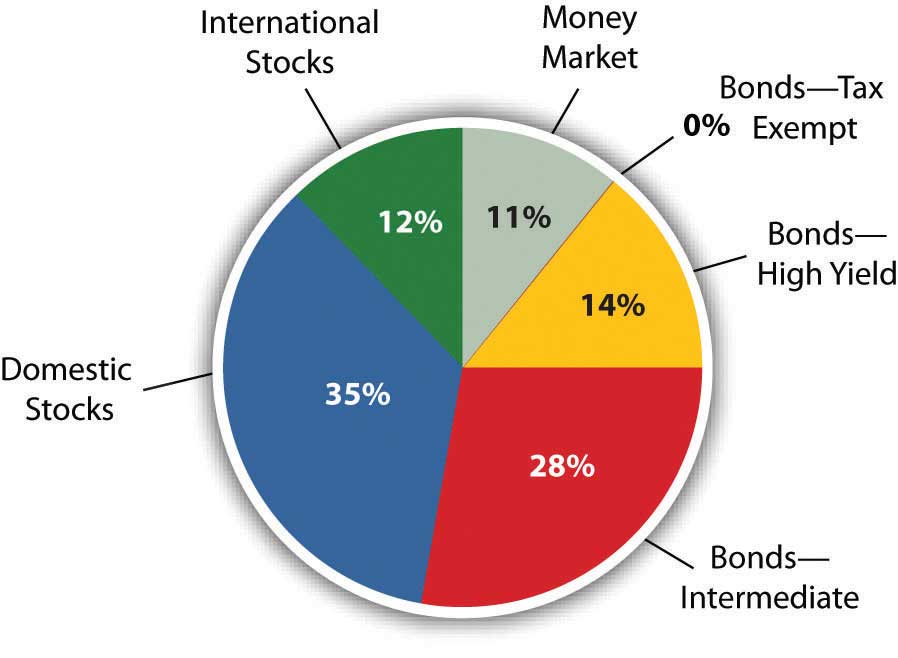

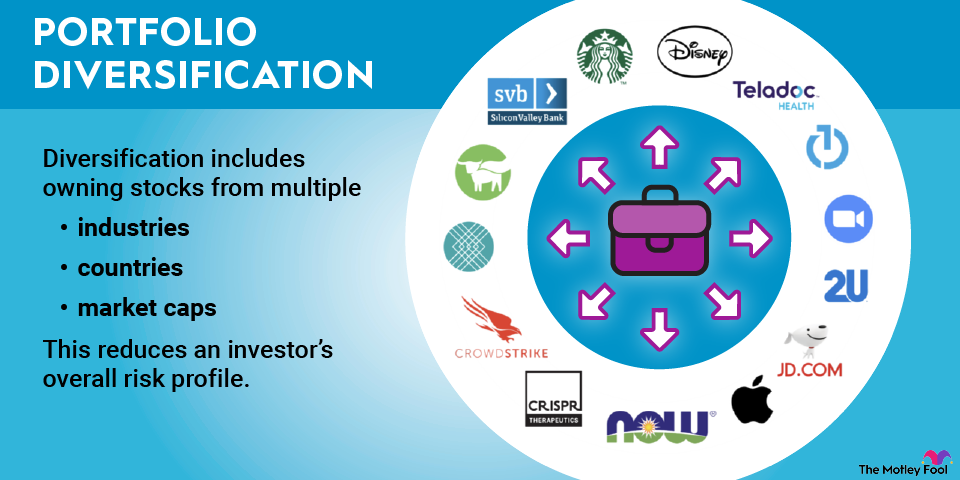

All investments involve risk, but smart investors manage risk through diversification—spreading money across different assets.

Key concepts:

- Risk is the chance your investment may lose value

- Return is the potential gain over time

- Diversification reduces risk by avoiding overexposure to one investment

Examples of diversification:

- Stocks + bonds

- U.S. + international markets

- Multiple industries and asset types

👉 Diversification doesn’t eliminate risk, but it makes investing more stable and predictable over time.

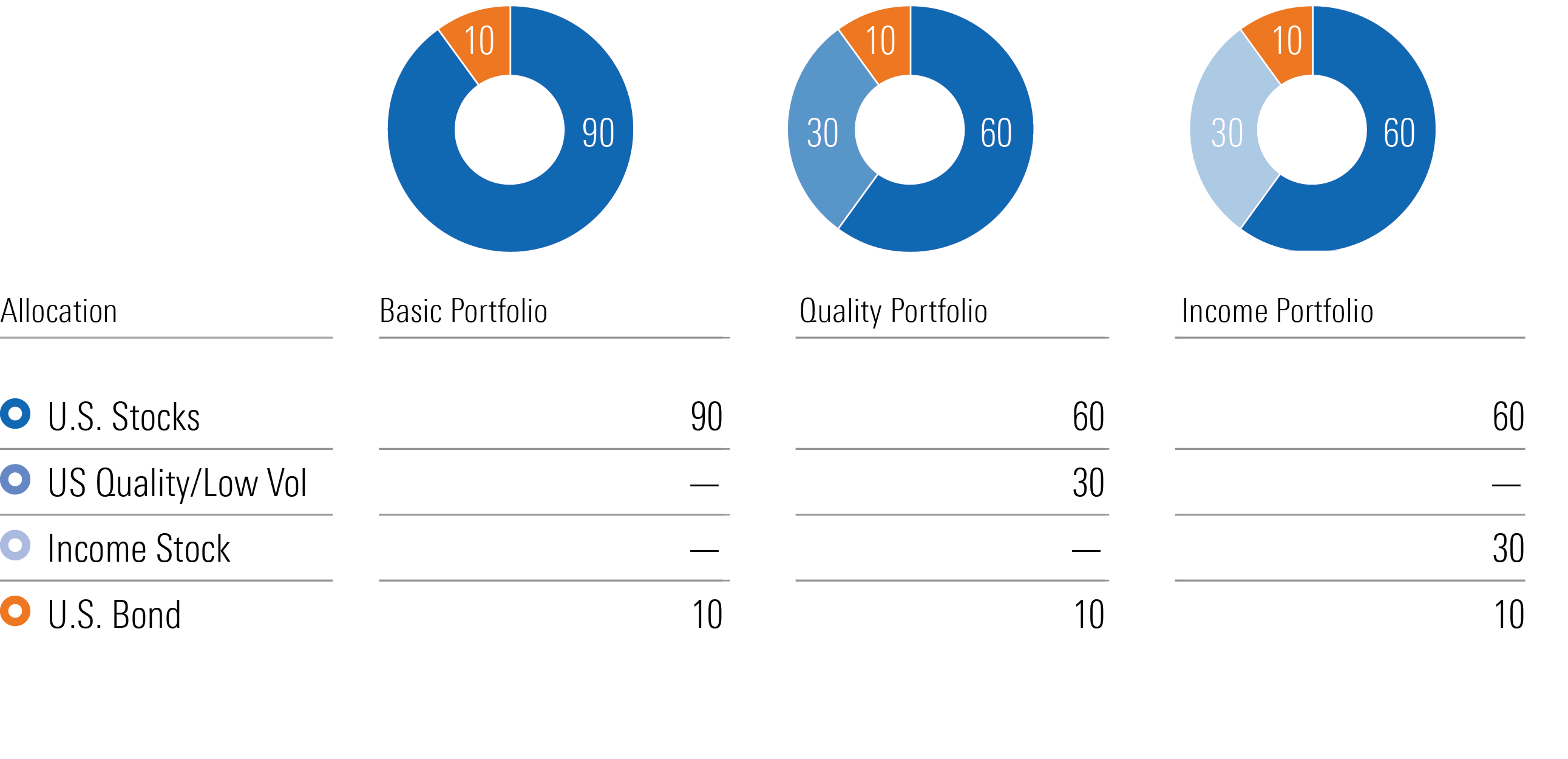

📊 Beginner-Friendly Investment Portfolios

You don’t need dozens of investments to build a solid portfolio.

Simple portfolio examples:

- Single-fund portfolio: Total market ETF

- Two-fund portfolio: U.S. stocks + bonds

- Three-fund portfolio: U.S. stocks, international stocks, bonds

General guidelines:

- Younger investors often hold more stocks

- More conservative investors hold more bonds

- Adjust risk as your goals and timeline change

👉 Simple portfolios are often more effective than complex ones.

Also read: Credit Cards, Rewards, and Points Strategy

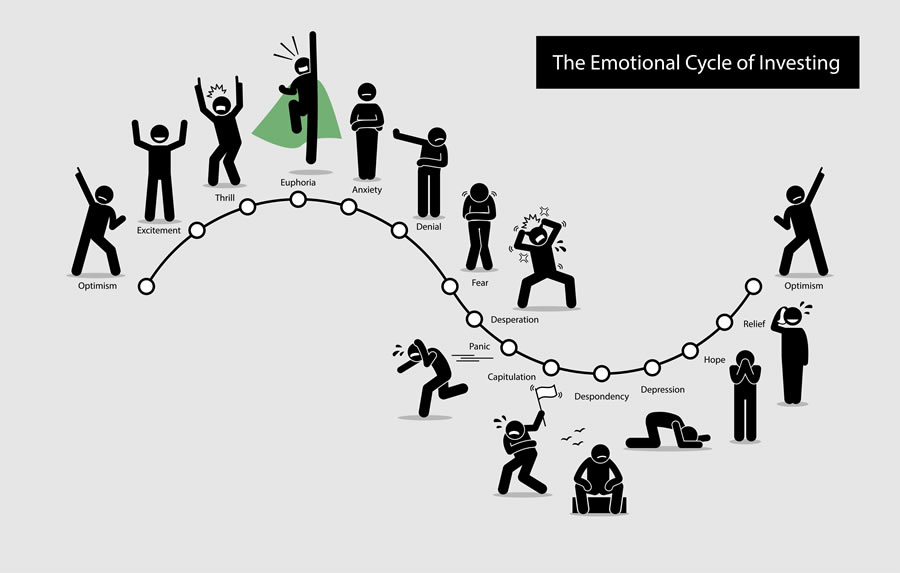

🚫 Common Investing Mistakes Beginners Make

Avoiding common mistakes is just as important as choosing the right investments.

Frequent beginner mistakes:

❌ Trying to time the market

❌ Investing without a clear goal

❌ Panicking during market downturns

❌ Chasing “hot” stocks or trends

❌ Ignoring fees and taxes

❌ Not investing at all due to fear

👉 Long-term success comes from patience, consistency, and discipline—not perfect timing.

✅ Final Thoughts

Investing doesn’t need to be complicated to be effective. By starting with small amounts, diversifying your investments, using simple portfolios, and avoiding emotional decisions, beginners can build confidence and long-term wealth.

The best time to start investing was yesterday. The second-best time is today.