Credit Cards, Rewards, and Points Strategy

How to Earn Benefits Without Going Into Debt

Credit cards are one of the most powerful—and misunderstood—financial tools in the United States. Used correctly, they can earn cash back, travel rewards, and valuable perks. Used incorrectly, they can lead to high-interest debt and long-term financial stress.

This guide explains:

- How credit card rewards work in the U.S.

- Cash back vs. travel rewards cards

- How to maximize points without going into debt

- Common mistakes people make with rewards programs

💳 How Credit Card Rewards Work in the U.S.

Credit card rewards are incentives offered by issuers to encourage spending. When you use a card, you earn rewards based on how much—and where—you spend.

Common reward types:

- Cash back – A percentage of your spending returned as cash

- Points – Redeemable for travel, gift cards, or statement credits

- Miles – Typically used for flights and travel expenses

Rewards are usually earned as:

- A flat rate (e.g., 1.5% on all purchases)

- Bonus categories (e.g., 3% on groceries or dining)

- Welcome bonuses after meeting a spending requirement

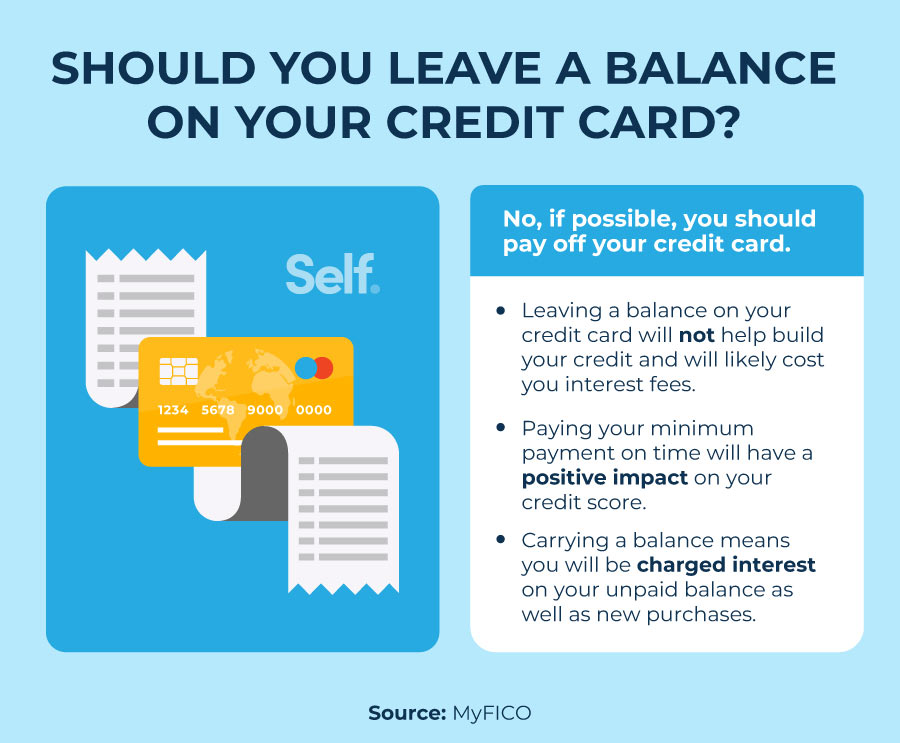

👉 Rewards are only valuable if you pay your balance in full every month.

💰 Cash Back vs. Travel Rewards Cards

Choosing between cash back and travel rewards depends on your lifestyle and spending habits.

Cash Back Cards

Pros:

- Simple and predictable

- Easy redemption

- Ideal for beginners

Cons:

- Lower maximum value compared to travel points

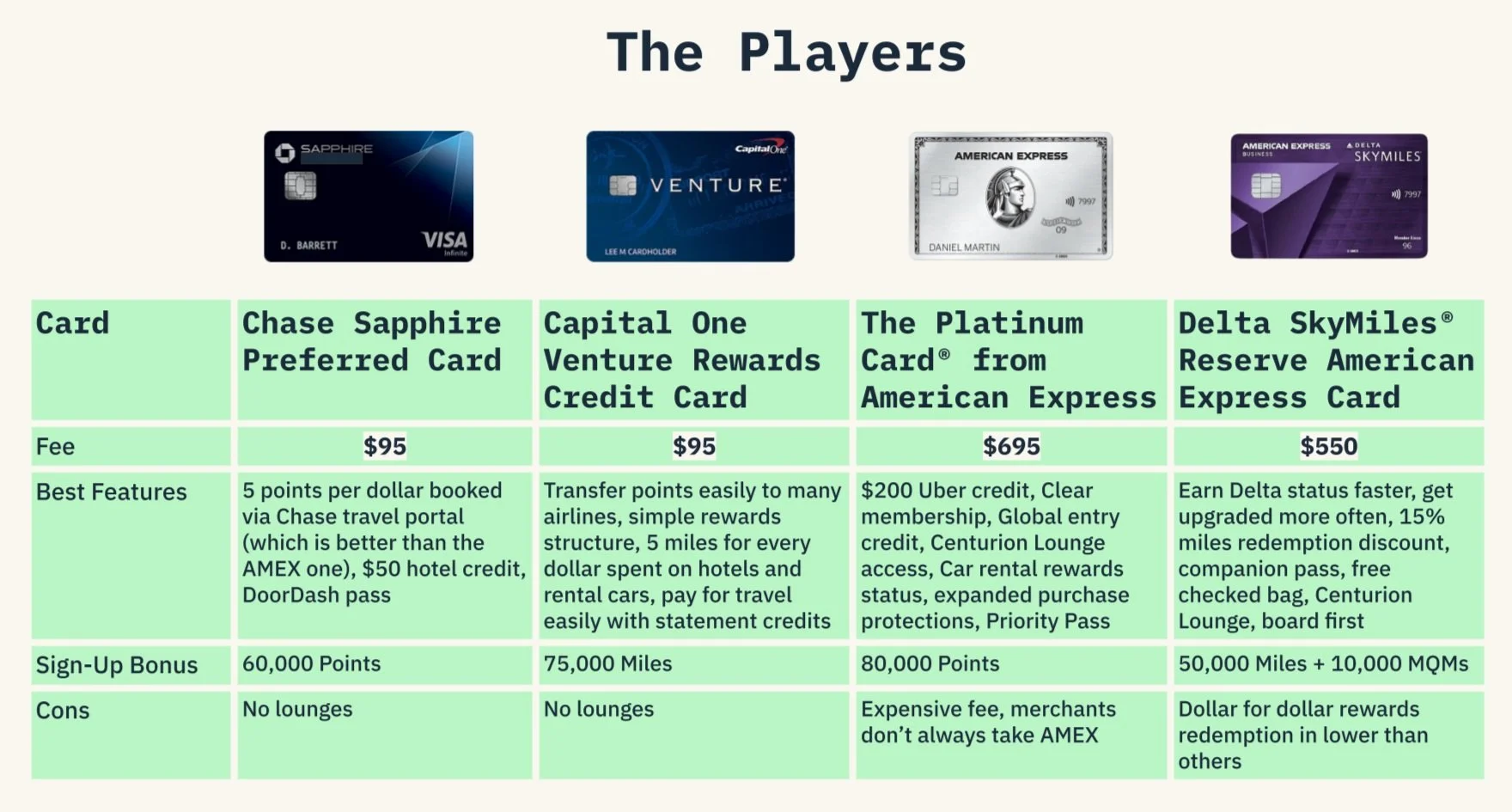

Travel Rewards Cards

Pros:

- Higher potential value

- Travel perks (free checked bags, lounge access)

- Flexible redemption options

Cons:

- More complex rules

- Often higher annual fees

- Best for frequent travelers

👉 If you don’t travel often, cash back cards usually offer better real-world value.

Also read: Personal Financial Planning in the U.S.

📈 How to Maximize Points Without Going Into Debt

The golden rule of credit card rewards: never spend more just to earn points.

Smart strategies:

- Use cards only for expenses you already budgeted

- Pay the statement balance in full every month

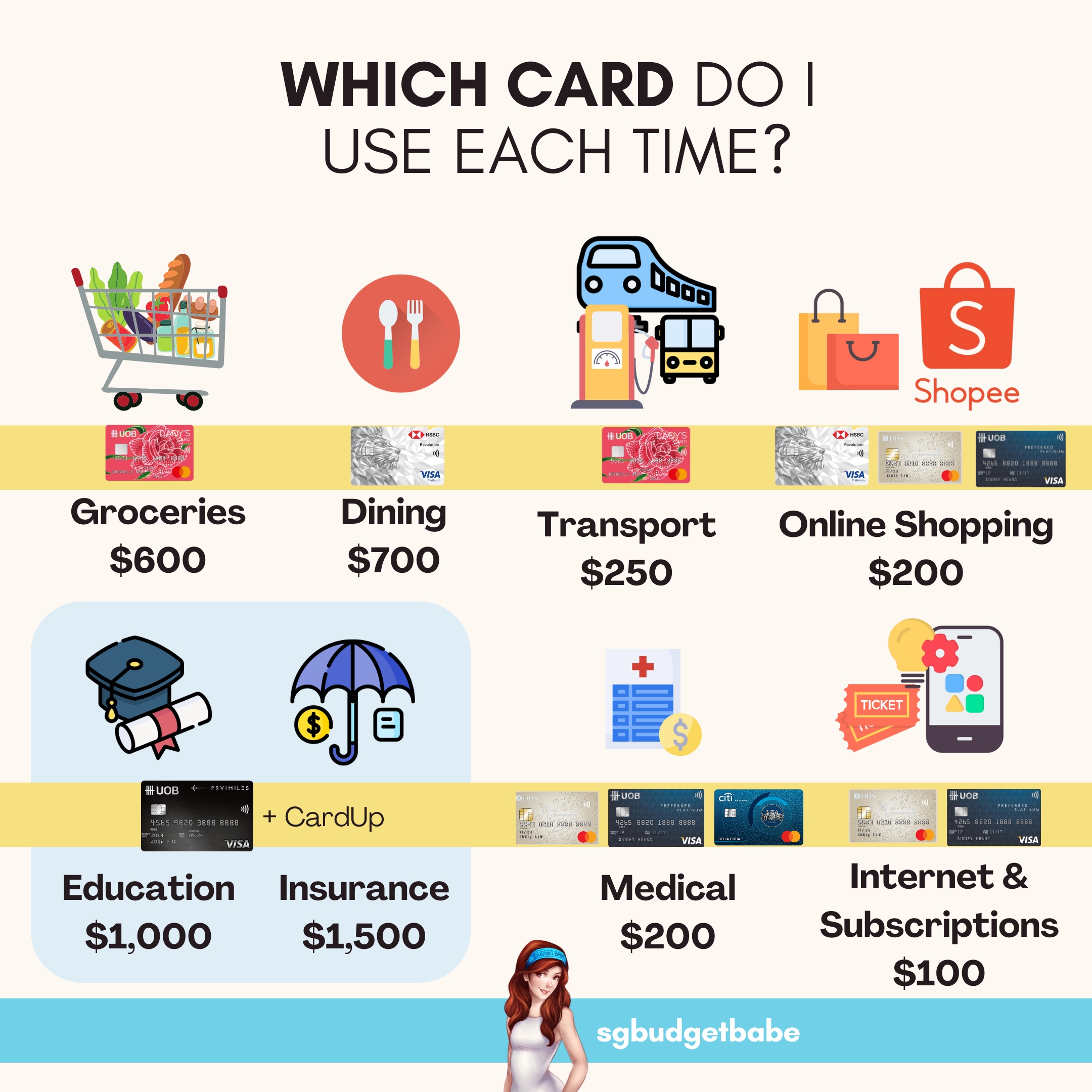

- Match cards to your spending categories

- Automate payments to avoid interest

- Track annual fees vs. rewards value

👉 One month of interest can erase an entire year of rewards.

🚫 Common Mistakes With Rewards Programs

Many people lose money chasing rewards without a strategy.

Common mistakes:

❌ Carrying a balance and paying interest

❌ Overspending to earn bonuses

❌ Ignoring annual fees

❌ Letting points expire

❌ Opening too many cards too quickly

❌ Redeeming points for low-value options

👉 Rewards should support your financial goals—not sabotage them.

✅ Final Thoughts

Credit cards and rewards programs can be incredibly valuable when used with discipline and intention. The key is simple: treat your credit card like a debit card, pay it off in full, and choose rewards that fit your lifestyle.

When managed correctly, credit card rewards are a bonus—not a risk.