Personal Financial Planning in the U.S.

A Practical Guide to Organizing Your Money

Advertising

Living in the United States offers many opportunities, but it also requires strong financial organization. The banking system, cost of living, and credit culture are very different from many other countries, and without planning, it’s easy to fall into financial traps.

In this guide, you’ll learn:

- How to build a monthly budget in the U.S.

- The difference between a checking account and a savings account

- How to build an emergency fund the right way

- Common financial mistakes immigrants make in the U.S.

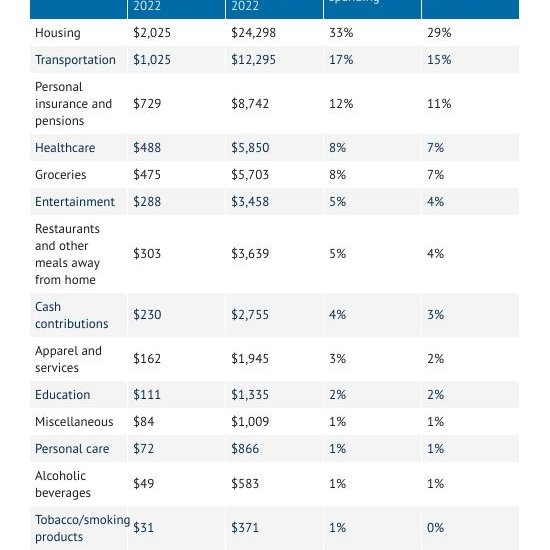

📊 How to Build a Monthly Budget in the U.S.

Step by step:

List your net monthly income

Include salary, side jobs, tips, and any additional income.

Map all expenses

Fixed: rent, utilities, internet, insurance, car payments

Variable: groceries, transportation, entertainment

Hidden: streaming subscriptions, apps, banking fees

Use the 50/30/20 rule (as a guideline)

50% needs

30% wants

20% savings and investments

Track it monthly

Small daily expenses can add up quickly by the end of the month.

👉 Tip: simple spreadsheets or budgeting apps make tracking much easier.

Also read: Credit Cards, Rewards, and Points Strategy

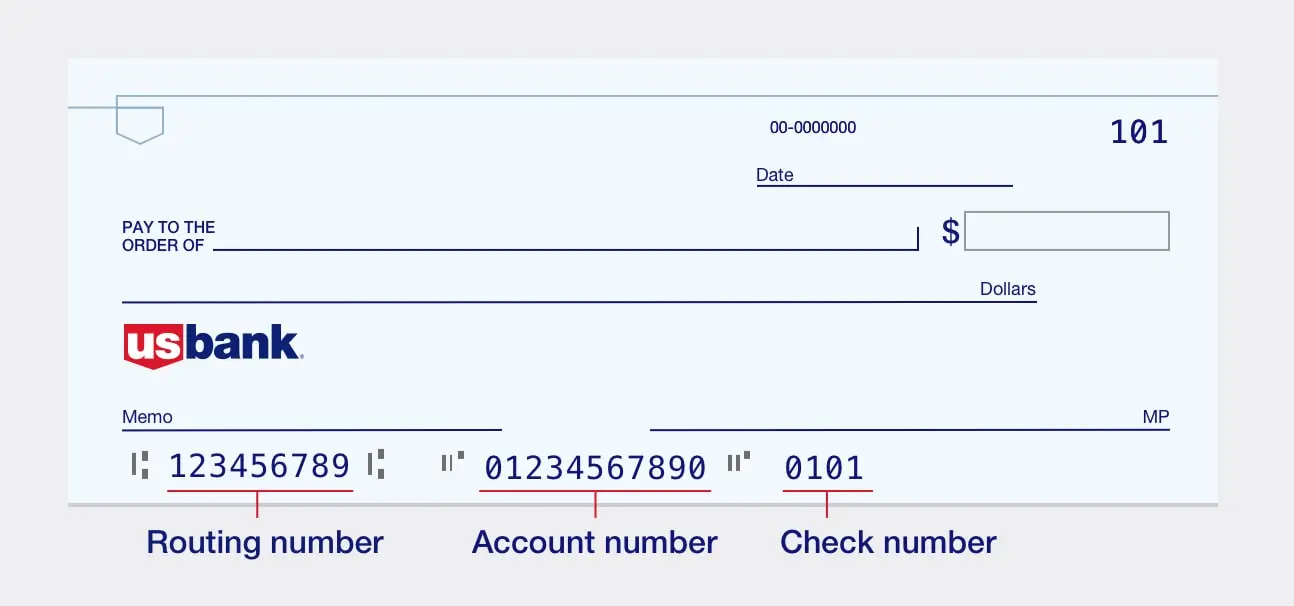

🏦 Checking Account vs. Savings Account: What’s the Difference?

Understanding U.S. bank accounts is essential to avoid unnecessary fees and manage your money efficiently.

Checking Account

- Used for daily expenses

- Comes with a debit card and checks

- Bill payments and direct deposit

- Usually does not earn interest

- May charge monthly fees if balance requirements are not met

Savings Account

- Designed for saving money

- Earns interest (often low, unless high-yield)

- Limited number of withdrawals per month

- Not ideal for frequent spending

👉 Smart strategy:

Use your checking account for expenses and your savings account for reserves and financial goals.

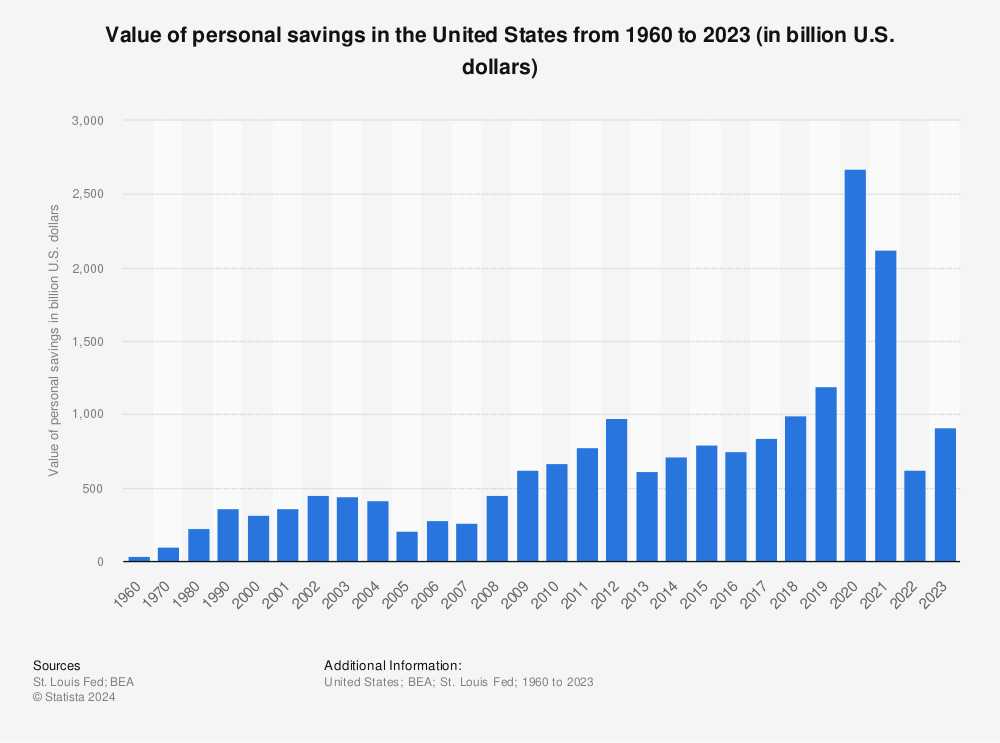

🚑 How to Build an Emergency Fund the Right Way

An emergency fund is essential in the U.S., where medical bills, job loss, and unexpected expenses can be very costly.

How much should you save?

The goal is 3 to 6 months of essential living expenses.

Where should you keep it?

- In a savings account

- In a high-yield savings account

- Never in high-risk investments

How to start:

- Set up automatic monthly transfers

- Prioritize it before investing

- Treat it like a mandatory bill

👉 An emergency fund protects you from debt, credit card overuse, and financial stress.

🚫 Common Financial Mistakes Immigrants Make in the U.S.

Many immigrants struggle financially not because of low income, but because of lack of information.

Most common mistakes:

❌ Not building a credit history

❌ Using credit cards as extra income

❌ Ignoring fees and interest rates

❌ Not planning for taxes

❌ Not having an emergency fund

👉 Fixing these mistakes early can make a huge difference in the long term.

Conclusion

Personal financial planning in the U.S. doesn’t have to be complicated—but it must be intentional. With a well-structured budget, organized bank accounts, an emergency fund, and the right information, you can build financial stability and make the most of the opportunities the country offers.

If you live in the United States or plan to move here, starting now can save you years of financial stress in the future.