Financial Planning for Major Life Decisions in the U.S.

Advertising

Big life decisions—like buying a home, planning for retirement, or managing student loans—have long-term financial consequences. In the United States, these choices are deeply connected to credit, interest rates, and strategic planning.

In this article, you’ll learn:

- Whether it’s better to buy or rent a home in the U.S.

- How mortgages work

- How to plan financially for retirement with 401(k)s and IRAs

- How to manage and repay student loans

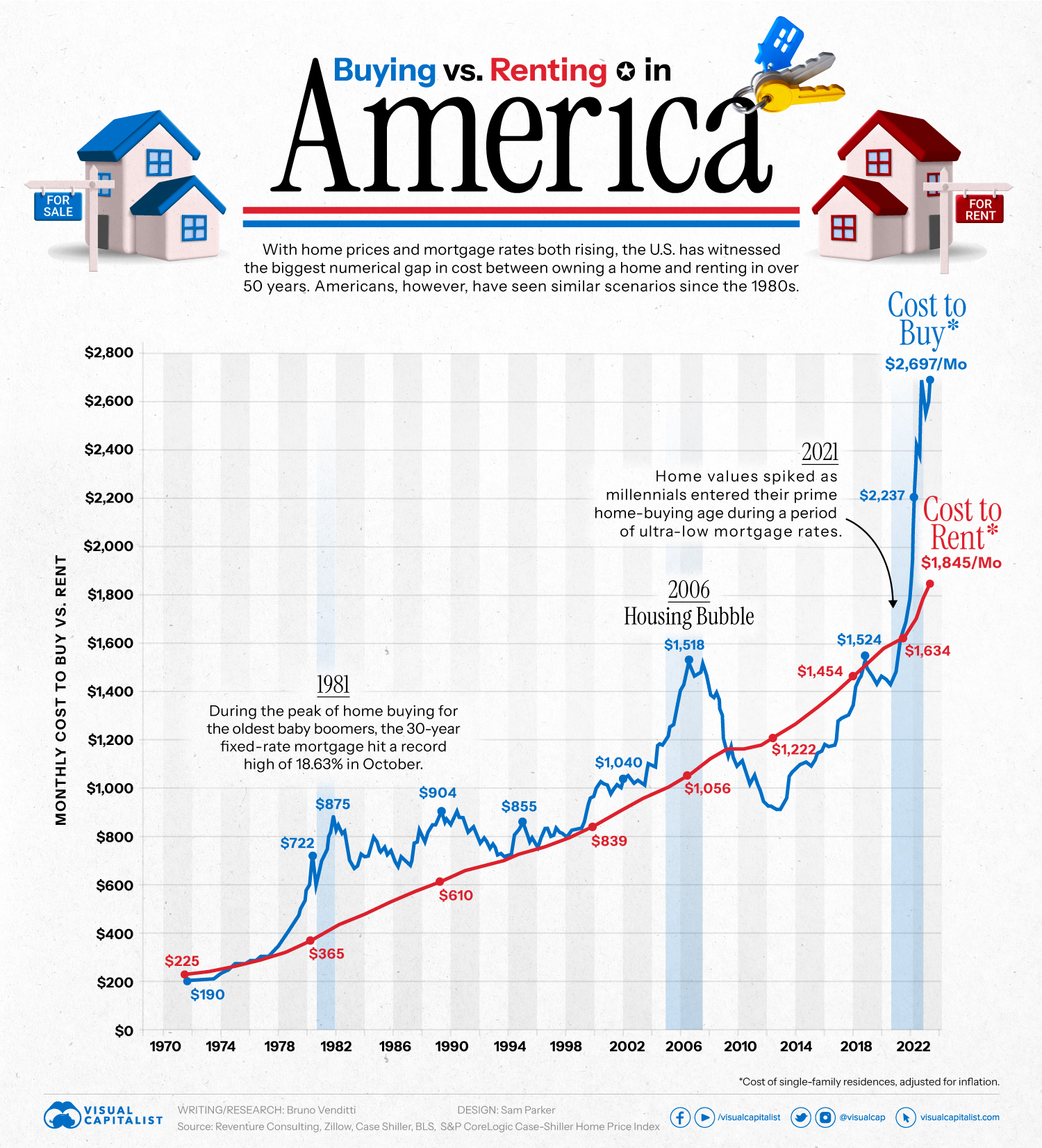

🏡 Buying vs. Renting a Home in the U.S.

One of the biggest financial questions people face in the U.S. is whether to buy or rent a home. The right choice depends on your financial situation, lifestyle, and long-term plans.

Renting may be better if:

- You plan to move within a few years

- You want flexibility and lower upfront costs

- You’re still building credit or savings

Buying may be better if:

- You plan to stay long-term

- You have stable income and good credit

- You want to build equity over time

👉 Buying a home is not just a lifestyle decision—it’s a long-term financial commitment.

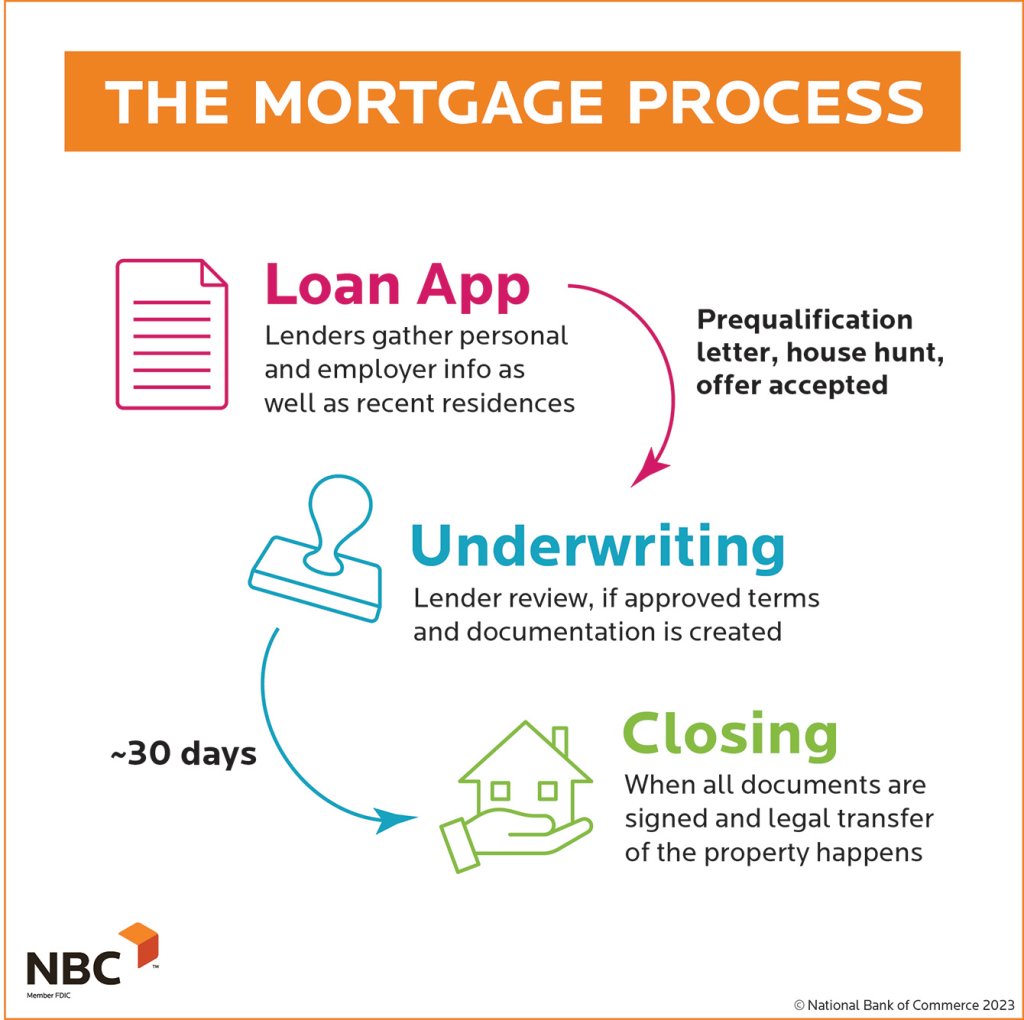

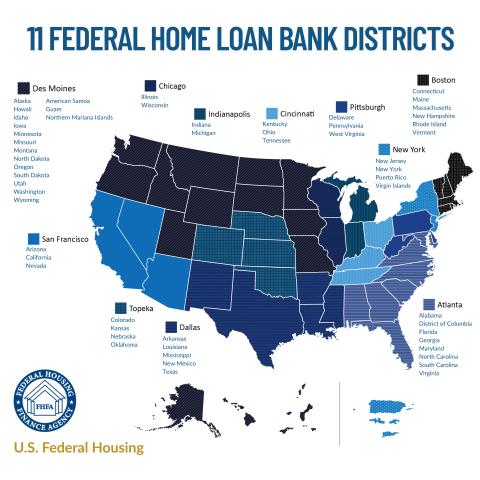

🏦 How Do Mortgages Work in the U.S.?

A mortgage is a loan used to purchase real estate. In the U.S., most mortgages are paid over 15 or 30 years.

Key mortgage components:

- Down payment – Typically 3% to 20% of the home price

- Interest rate – Fixed or adjustable

- Principal – The amount borrowed

- Property taxes and insurance – Often included in monthly payments

Common mortgage types:

- Fixed-rate mortgages

- Adjustable-rate mortgages (ARM)

- FHA loans (popular with first-time buyers)

👉 Your credit score strongly affects your interest rate and total cost of the loan.

🧓 Retirement Planning: 401(k) and IRA

Retirement planning is essential in the U.S., where individuals are largely responsible for their own retirement savings.

- Offered by employers

- Contributions are often matched by employers

- Contributions are typically pre-tax

- Annual contribution limits apply

- IRA (Individual Retirement Account)Opened independently

- Traditional IRA: tax-deferred contributions

- Roth IRA: tax-free withdrawals in retirement

👉 Starting early allows compound growth to work in your favor.

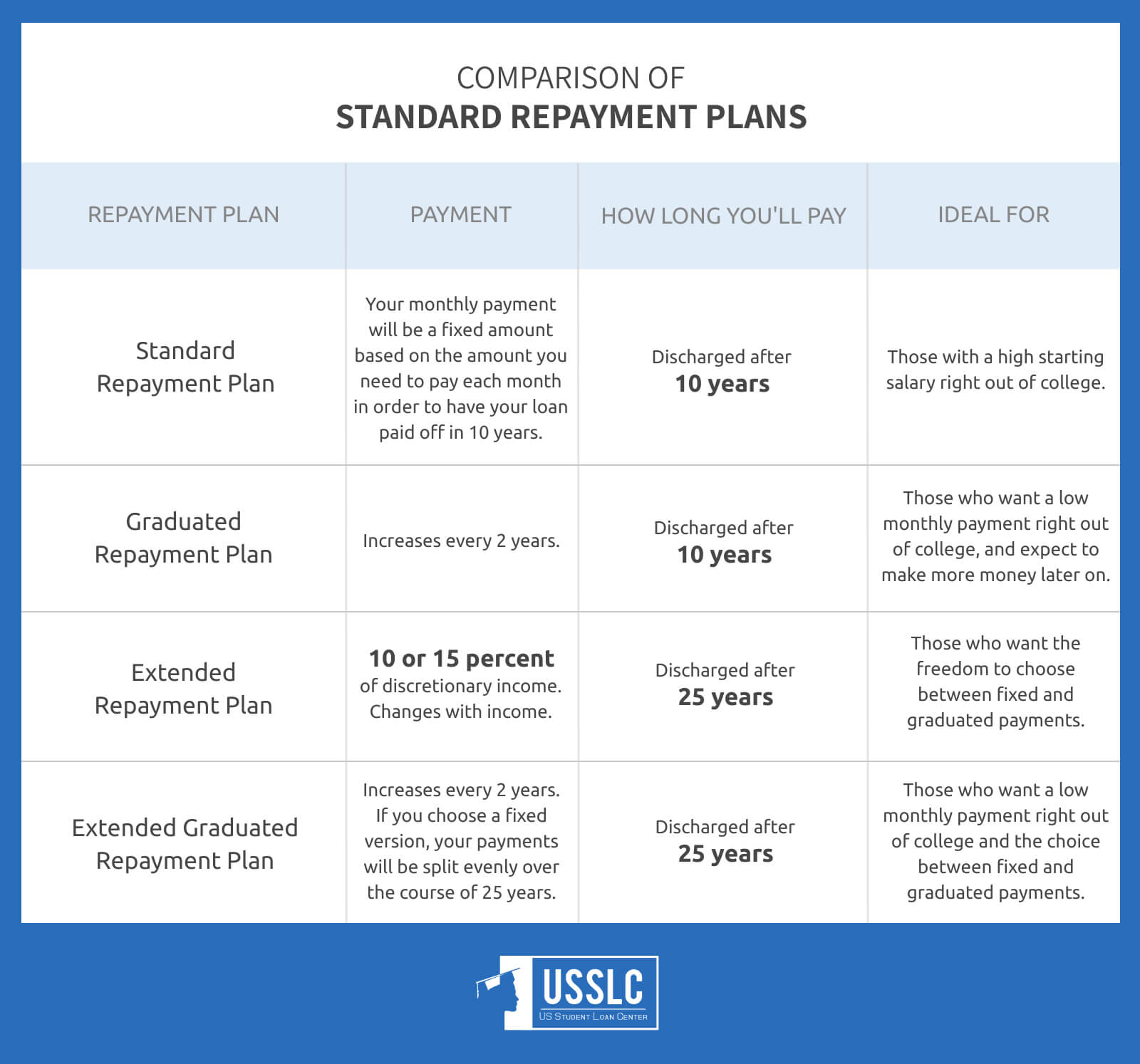

🎓 How to Manage Student Loans

Student loans are common in the U.S. and can significantly affect your financial future if not managed properly.

Smart strategies:

- Understand whether your loans are federal or private

- Choose the right repayment plan (standard, income-driven, etc.)

- Make extra payments when possible to reduce interest

- Avoid deferment unless absolutely necessary

👉 A clear repayment strategy can prevent student debt from delaying other financial goals.

✅ Final Thoughts

Major life decisions require more than emotion—they require financial planning. Whether you’re deciding where to live, preparing for retirement, or paying off education debt, understanding the financial implications helps you make confident, informed choices.

The earlier you plan, the more options and flexibility you’ll have in the future.