Financial Planning by Life Stage

How to Manage Money Through Every Phase of Life

Advertising

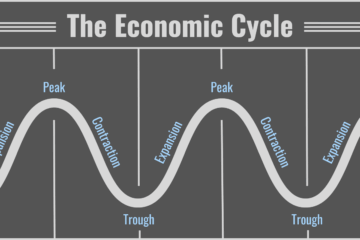

Personal finance isn’t static—your priorities, risks, and goals evolve as your life changes. What makes sense financially in your 20s looks very different in your 40s or 60s. Understanding financial planning by life stage helps you make smarter decisions and avoid costly mistakes along the way.

In this article, you’ll learn:

- How personal finance priorities change in your 20s, 30s, 40s, and beyond

- Key financial goals for young professionals

- How to do a mid-career financial checkup

- How to prepare financially for major life transitions

🎓 Personal Finance in Your 20s, 30s, 40s, and Beyond

Each stage of life comes with different financial opportunities and risks.

Your 20s: Build the Foundation

- Create a budget and emergency fund

- Start building credit

- Begin investing early—even small amounts

- Avoid high-interest debt

👉 Time is your biggest advantage in your 20s.

Your 30s: Growth and Stability

- Increase retirement contributions

- Balance investing with major expenses (home, family)

- Protect income with insurance

- Plan for medium-term goals

Your 40s: Optimization

- Maximize retirement savings

- Review investment allocation

- Prepare for education costs and aging parents

- Reduce lifestyle inflation

50s and Beyond: Protection and Transition

- Focus on wealth preservation

- Plan retirement income strategy

- Reduce risk and unnecessary debt

- Prepare for healthcare and estate planning

🚀 Financial Priorities for Young Professionals

Early career decisions have an outsized impact on long-term financial success.

Top priorities:

- Living below your means

- Automating savings and investments

- Taking advantage of employer benefits

- Building marketable skills to grow income

👉 Increasing income early often matters more than cutting every expense.

🔍 Mid-Career Financial Checkups

Mid-career is the perfect time to pause and reassess your financial direction.

What to review:

- Net worth and cash flow

- Retirement savings progress

- Investment risk and diversification

- Insurance coverage

- Tax efficiency

👉 A financial checkup helps correct course before small issues become big problems.

🔄 Preparing Financially for Major Life Transitions

Major life events often come with major financial consequences.

Common transitions to plan for:

- Marriage or divorce

- Buying or selling a home

- Having children

- Career changes or entrepreneurship

- Retirement

Smart preparation strategies:

- Build extra savings before transitions

- Review legal and beneficiary documents

- Adjust insurance and estate plans

- Revisit your budget and goals

👉 Planning ahead reduces stress and protects your long-term financial health.

✅ Final Thoughts

Financial planning works best when it evolves with your life. By understanding the priorities of each life stage, reviewing your finances regularly, and preparing for major transitions, you create flexibility, resilience, and confidence—no matter what comes next.

Personal finance isn’t about perfection. It’s about making intentional choices at the right time.