Housing Costs and Cost of Living in the U.S.

How to Budget Smarter Where You Live

Advertising

Housing is the largest expense for most households in the United States. Whether you rent or own, where you live—and how you manage housing-related costs—has a major impact on your overall financial health.

From rising rents to hidden utility expenses, understanding housing costs is essential for building a realistic budget and avoiding financial strain.

In this article, you’ll learn:

- How housing costs vary by state and city

- How to lower your monthly housing expenses

- How to budget for utilities and hidden housing costs

🏙️ How Housing Costs Vary by State and City

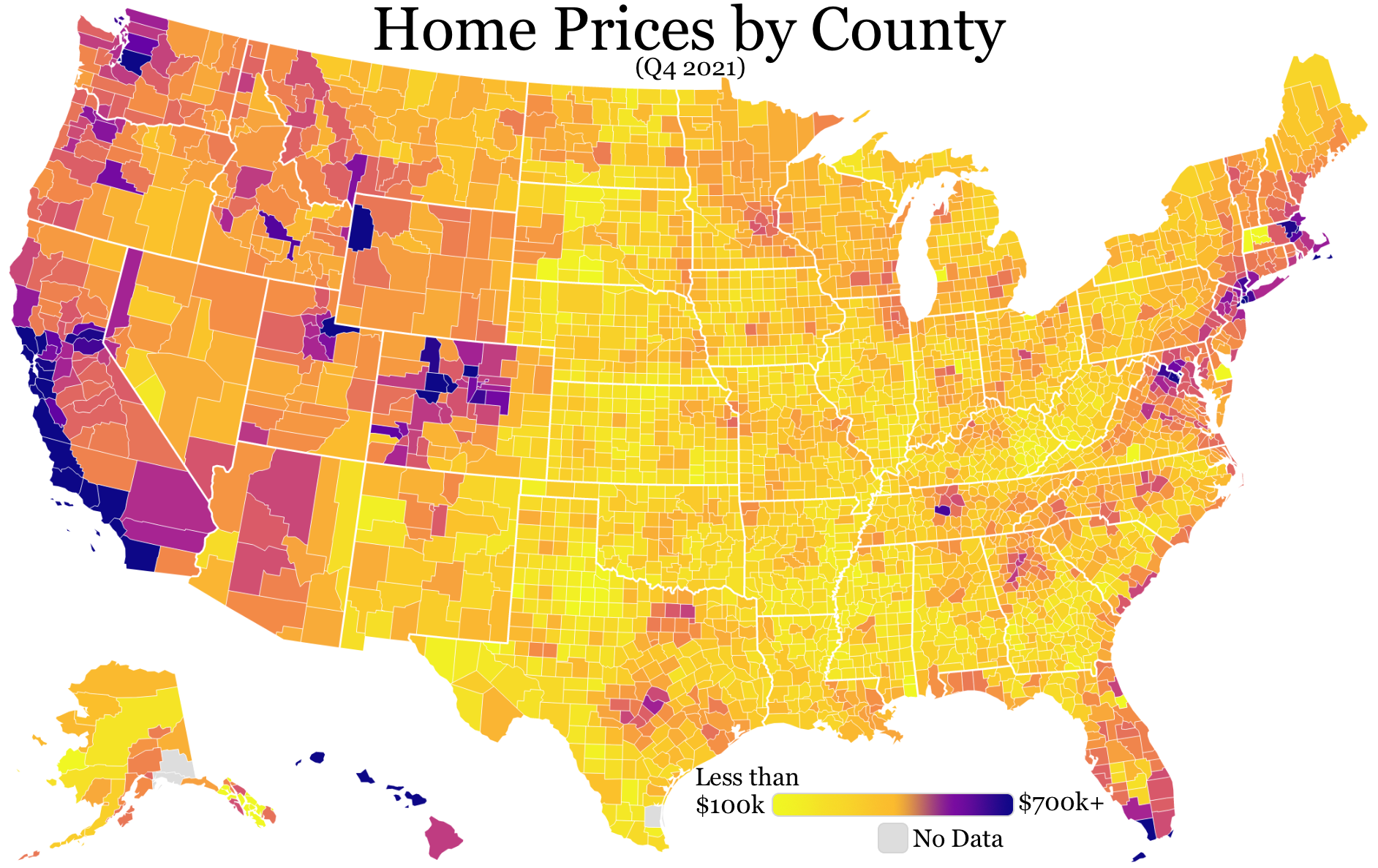

Housing costs in the U.S. vary dramatically depending on location. Two households earning the same income can have very different financial outcomes based solely on where they live.

High-cost housing markets

Cities like New York, San Francisco, Los Angeles, Boston, and Seattle typically have:

- High rent and home prices

- Competitive housing markets

- Higher property taxes and insurance

- Higher overall cost of living

In these areas, housing can easily consume 35–50% of income, putting pressure on savings and other goals.

Lower-cost housing markets

Many cities in the Midwest and South offer:

- Lower rents and home prices

- More space for the same cost

- Lower property taxes and insurance

In these regions, housing may take 20–30% of income, allowing more room for saving, investing, or lifestyle flexibility.

👉 Choosing where to live is one of the most powerful financial decisions you can make.

💸 How to Lower Your Monthly Housing Expenses

While you can’t always control market prices, you can often reduce housing costs with intentional choices.

Also check out: Remote Work, Relocation, and Cost-of-Living Arbitrage

Practical ways to lower housing expenses:

- Downsize to a smaller apartment or home

- Move slightly outside city centers where rents are lower

- Get a roommate to share costs

- Negotiate rent when renewing a lease

- Refinance a mortgage if interest rates drop

- Appeal property taxes if your home is over-assessed

Rent vs. buy considerations

Buying isn’t always cheaper than renting—especially in high-cost markets. A smart decision considers:

- Length of time you plan to stay

- Total monthly cost (mortgage, taxes, insurance, maintenance)

- Opportunity cost of tying up cash

👉 Lower housing costs free up cash for emergency savings, debt payoff, and investing.

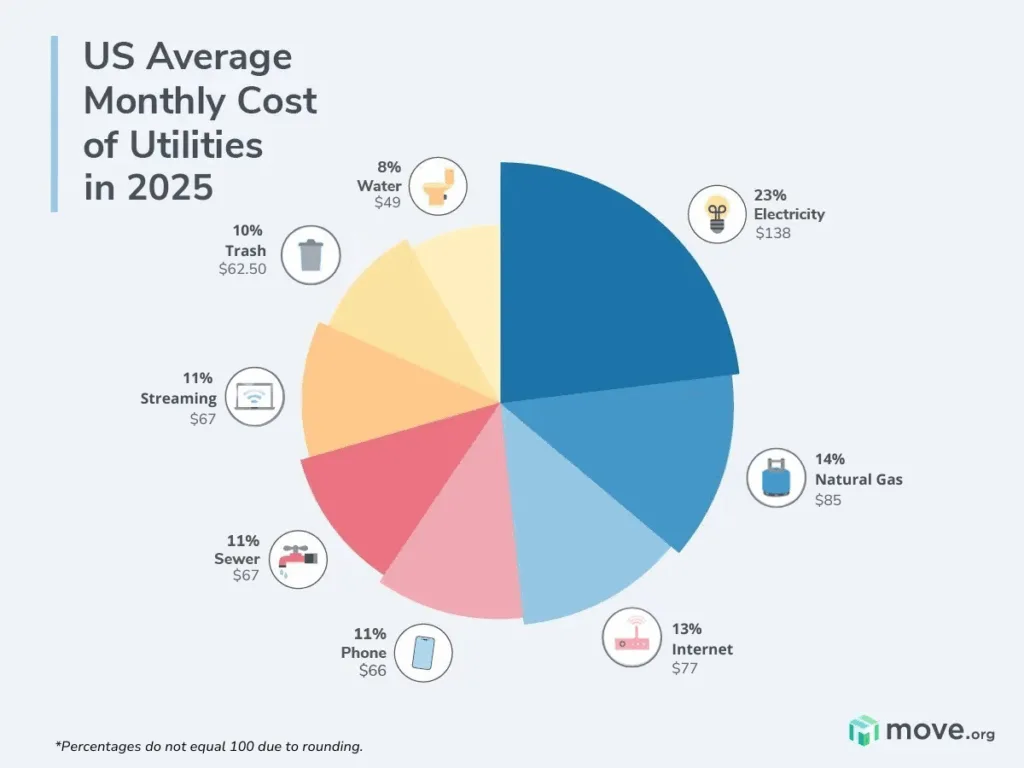

🔌 Budgeting for Utilities and Hidden Housing Costs

Housing expenses go far beyond rent or a mortgage payment. Many people underestimate hidden and variable costs.

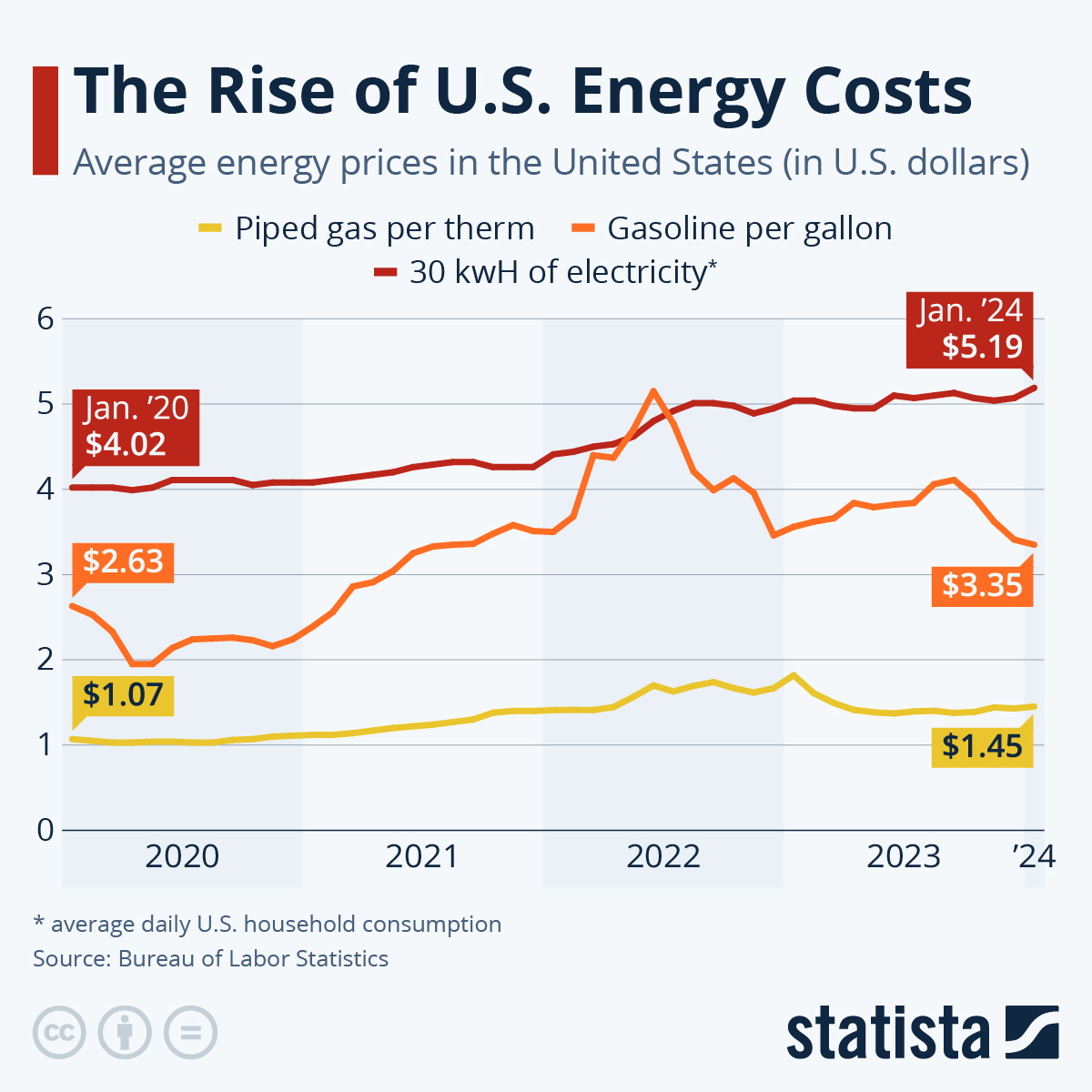

Common utility costs:

Electricity

- Gas

- Water and sewer

- Trash collection

- Internet and cable

Utility costs can fluctuate by:

- Season (heating and cooling)

- Home size and insulation

- Local utility rates

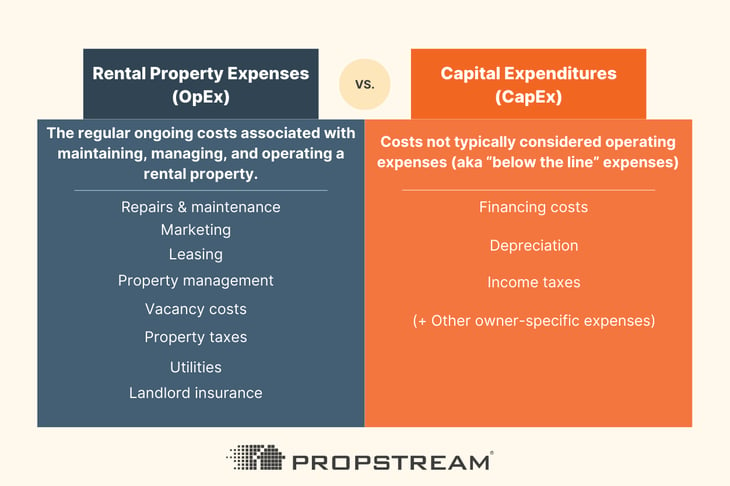

Often-overlooked housing costs:

Maintenance and repairs

- HOA fees

- Parking fees

- Renter’s or homeowner’s insurance

- Lawn care or snow removal

- Pest control

Smart budgeting tips:

- Review past utility bills before moving

- Ask landlords or sellers for average costs

- Budget a monthly maintenance fund (1–3% of home value annually for homeowners)

- Track utilities separately from rent or mortgage

👉 Hidden housing costs can quietly break a budget if they’re not planned for.

📊 How Housing Costs Affect Your Overall Budget

A common guideline suggests spending no more than 30% of gross income on housing. While this isn’t always realistic—especially in expensive cities—it’s still a useful benchmark.

When housing costs exceed that range, people often:

- Reduce retirement contributions

- Accumulate credit card debt

- Delay major life goals

- Experience higher financial stress

👉 The goal isn’t a perfect percentage—it’s sustainability.

If housing costs are high, it becomes even more important to:

- Control other expenses

- Increase income strategically

- Avoid lifestyle inflation

🧠 Housing Choices and Financial Flexibility

Housing decisions affect more than your monthly bills—they shape your financial flexibility.

Lower housing costs can mean:

- Faster debt repayment

- Larger emergency fund

- More investing opportunities

- Greater career flexibility

Higher housing costs may be worthwhile if they support:

- Career growth

- Family needs

- Long-term stability

👉 The “right” housing cost is one that aligns with your income, goals, and lifestyle.

✅ Final Thoughts

Housing is the foundation of your cost of living in the U.S. By understanding how prices vary by location, actively managing housing expenses, and budgeting for utilities and hidden costs, you gain control over one of the biggest drivers of your financial life.

You don’t need the cheapest home—you need the right housing choice for your financial goals.

Smart housing decisions today create breathing room, resilience, and opportunity tomorrow.