Taxes in the United States

A Practical Guide to Income Tax and Filing

Taxes are a fundamental part of financial life in the United States. Understanding how the U.S. tax system works helps you avoid penalties, reduce your tax bill legally, and plan your finances more efficiently.

In this guide, you’ll learn:

- How income tax works in the U.S.

- The difference between W-2 and 1099 income

- Common tax deductions and credits

- Common mistakes when filing taxes

🧾 How Does Income Tax Work in the U.S.?

The U.S. uses a progressive income tax system, meaning the more you earn, the higher the tax rate applied to portions of your income.

Key points:

- Federal income tax is mandatory nationwide

- State and local taxes may also apply, depending on where you live

- Taxes are typically withheld from paychecks throughout the year

- At tax time, you either receive a refund or owe additional taxes

The tax year runs from January 1 to December 31, and tax returns are usually due by April 15 of the following year.

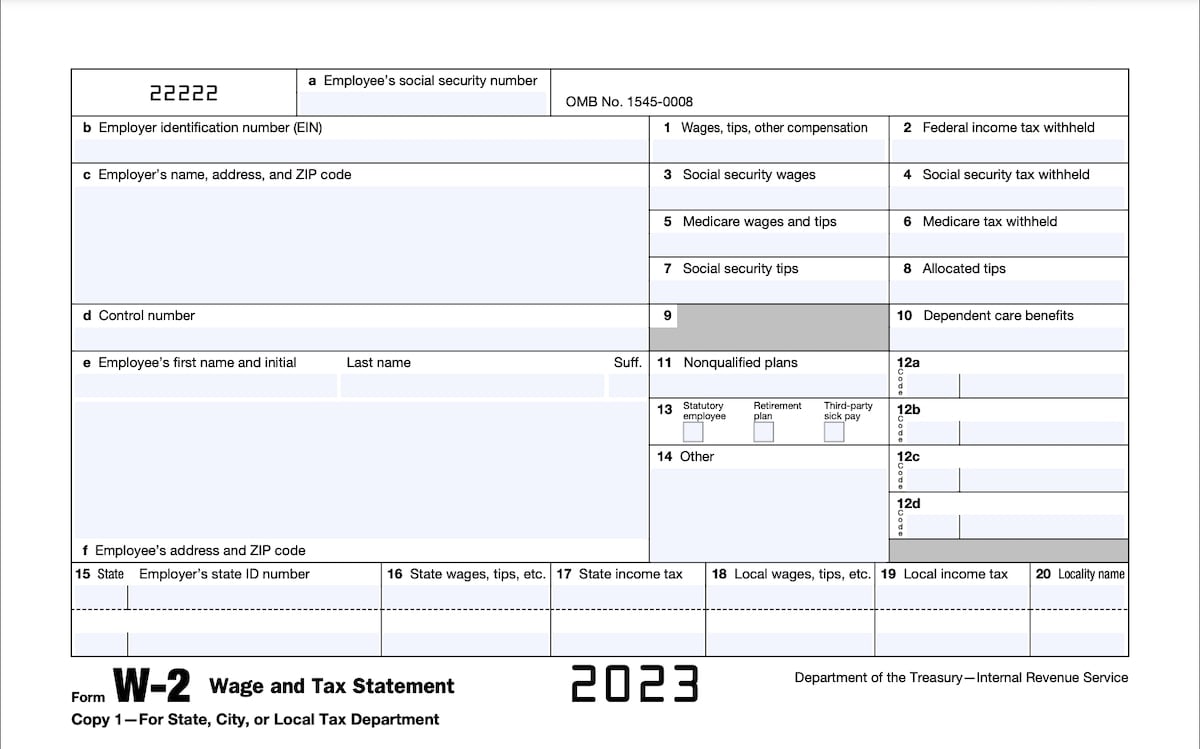

📄 W-2 vs. 1099: What’s the Difference?

Understanding whether you receive a W-2 or a 1099 form is critical, as it affects how much tax you owe and how you file.

W-2 (Employee)

- Issued to employees

- Taxes are withheld automatically

- Employer pays part of Social Security and Medicare taxes

- Simpler tax filing

1099 (Independent Contractor / Self-Employed)

- Issued to freelancers and contractors

- No taxes are withheld

- You are responsible for paying income tax and self-employment tax

- Requires estimated quarterly tax payments

👉 Many tax surprises happen because people underestimate how much tax they owe on 1099 income.

💰 Most Common Tax Deductions and Credits

Tax deductions and credits can significantly reduce your tax bill if used correctly.

Common deductions:

- Standard deduction (used by most taxpayers)

- Mortgage interest

- Student loan interest

- Charitable donations

Common tax credits:

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- Education credits

- Child and Dependent Care Credit

👉 Deductions reduce taxable income, while credits reduce the tax owed dollar for dollar.

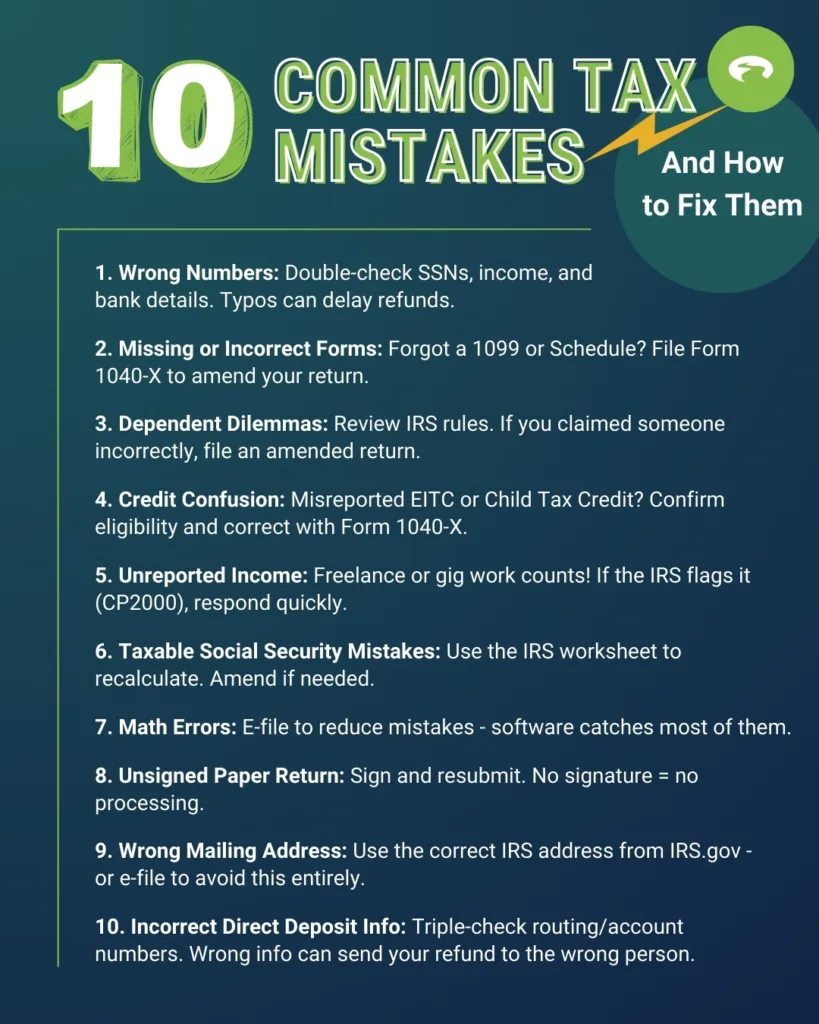

🚫 Common Mistakes When Filing Taxes

Many taxpayers make avoidable mistakes that lead to delays, penalties, or audits.

Most common errors:

❌ Reporting incorrect income

❌ Forgetting side income or freelance work

❌ Filing with the wrong status

❌ Missing deductions or credits

❌ Filing late or not filing at all

👉 Keeping organized records and reviewing your return carefully can prevent costly issues.

✅ Final Thoughts

Understanding taxes in the United States doesn’t have to be overwhelming. With basic knowledge about income tax, forms like W-2 and 1099, and available deductions and credits, you can file confidently and make smarter financial decisions.

Whether you’re an employee, freelancer, or business owner, being proactive about taxes is a key part of financial success.