Credit, Debt, and Credit Score in the U.S

Advertising

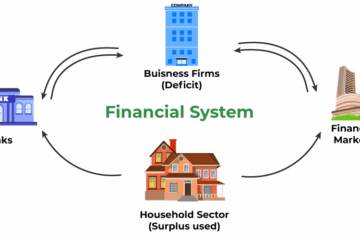

Credit plays a central role in the U.S. financial system. Your credit score affects your ability to rent an apartment, finance a car, buy a home, and even get better insurance rates. Understanding how credit works—and how to manage debt responsibly—is essential for financial success in the United States.

In this article, you’ll learn:

- What a credit score is and how it works

- How to increase your credit score faster

- Best credit cards for beginners

- Practical strategies to get out of debt in the U.S.

📊 What Is a Credit Score and How Does It Work?

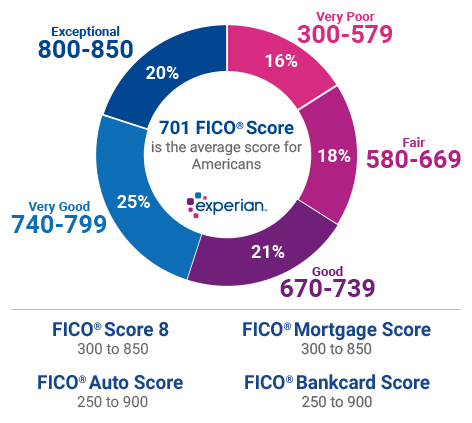

A credit score is a three-digit number that represents your creditworthiness—how likely you are to repay borrowed money. In the U.S., the most common scoring model is the FICO Score, which typically ranges from 300 to 850.

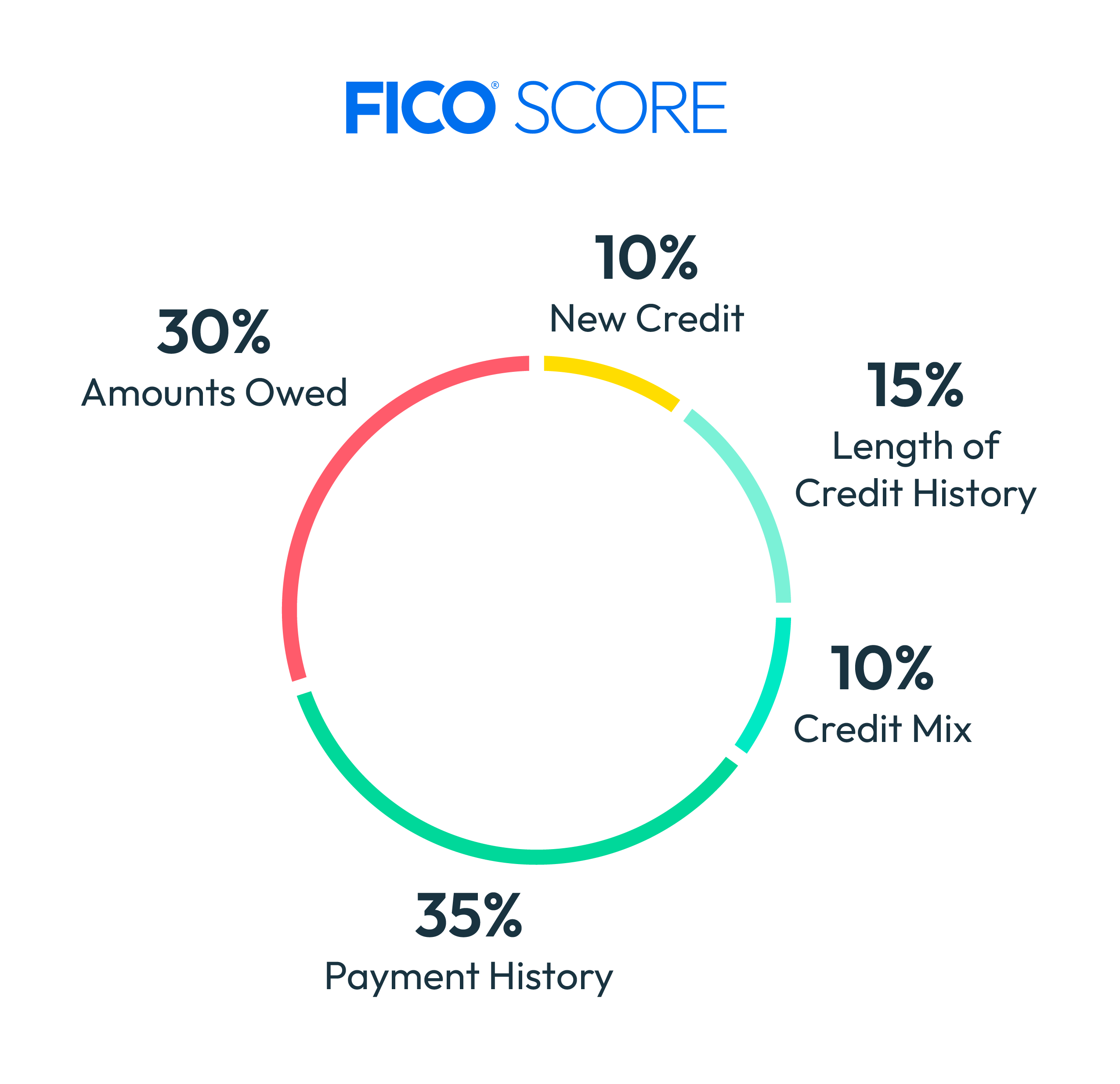

Main factors that affect your credit score:

- Payment history (35%) – Do you pay your bills on time?

- Credit utilization (30%) – How much of your available credit are you using?

- Length of credit history (15%) – How long you’ve had credit

- Credit mix (10%) – Credit cards, loans, mortgages, etc.

- New credit inquiries (10%) – Recent applications for credit

A higher credit score means better loan terms, lower interest rates, and more financial opportunities.

🚀 How to Increase Your Credit Score Faster

While building credit takes time, there are proven strategies that can help improve your score faster.

Effective actions:

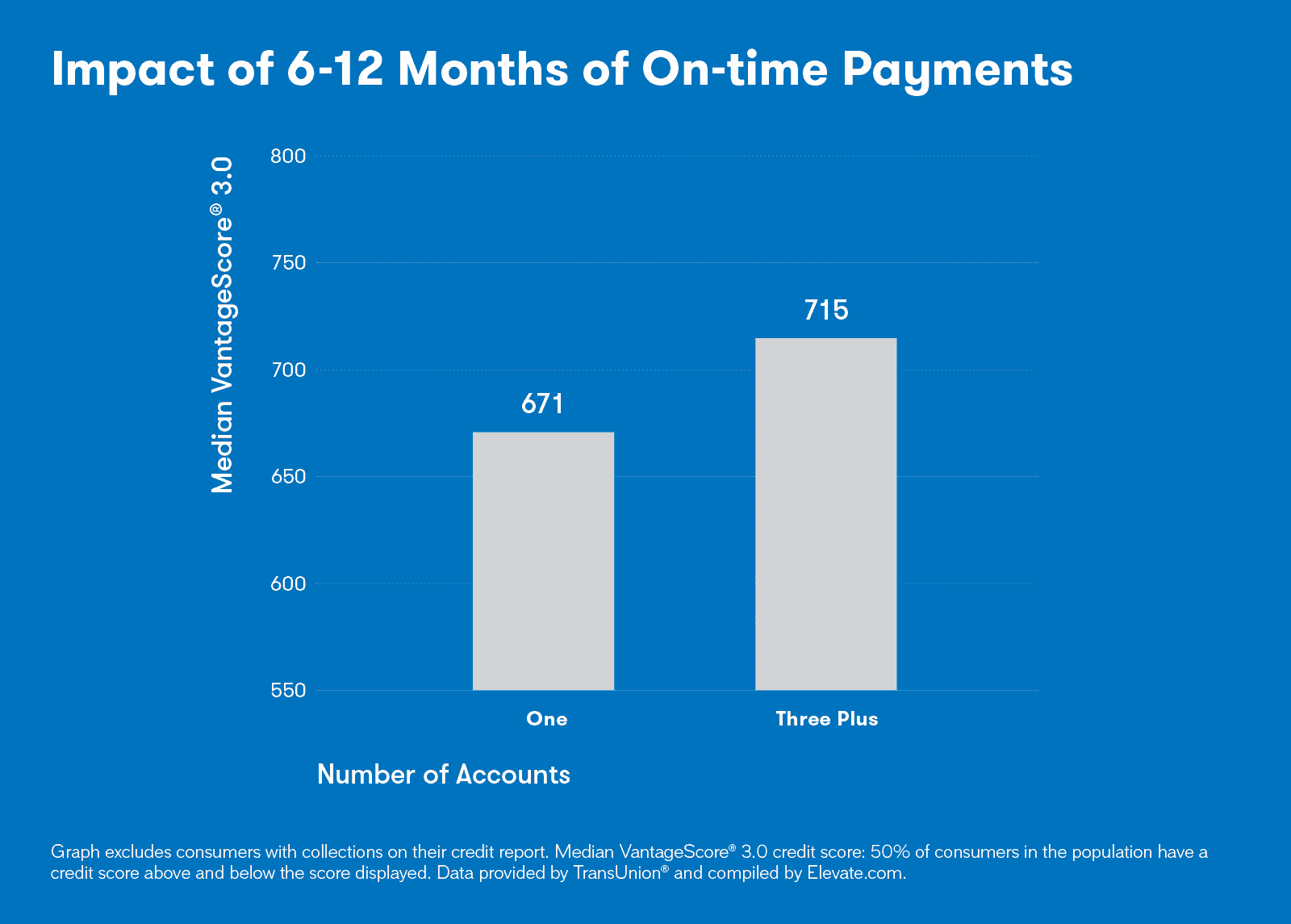

- Pay all bills on time – Even one late payment can hurt your score

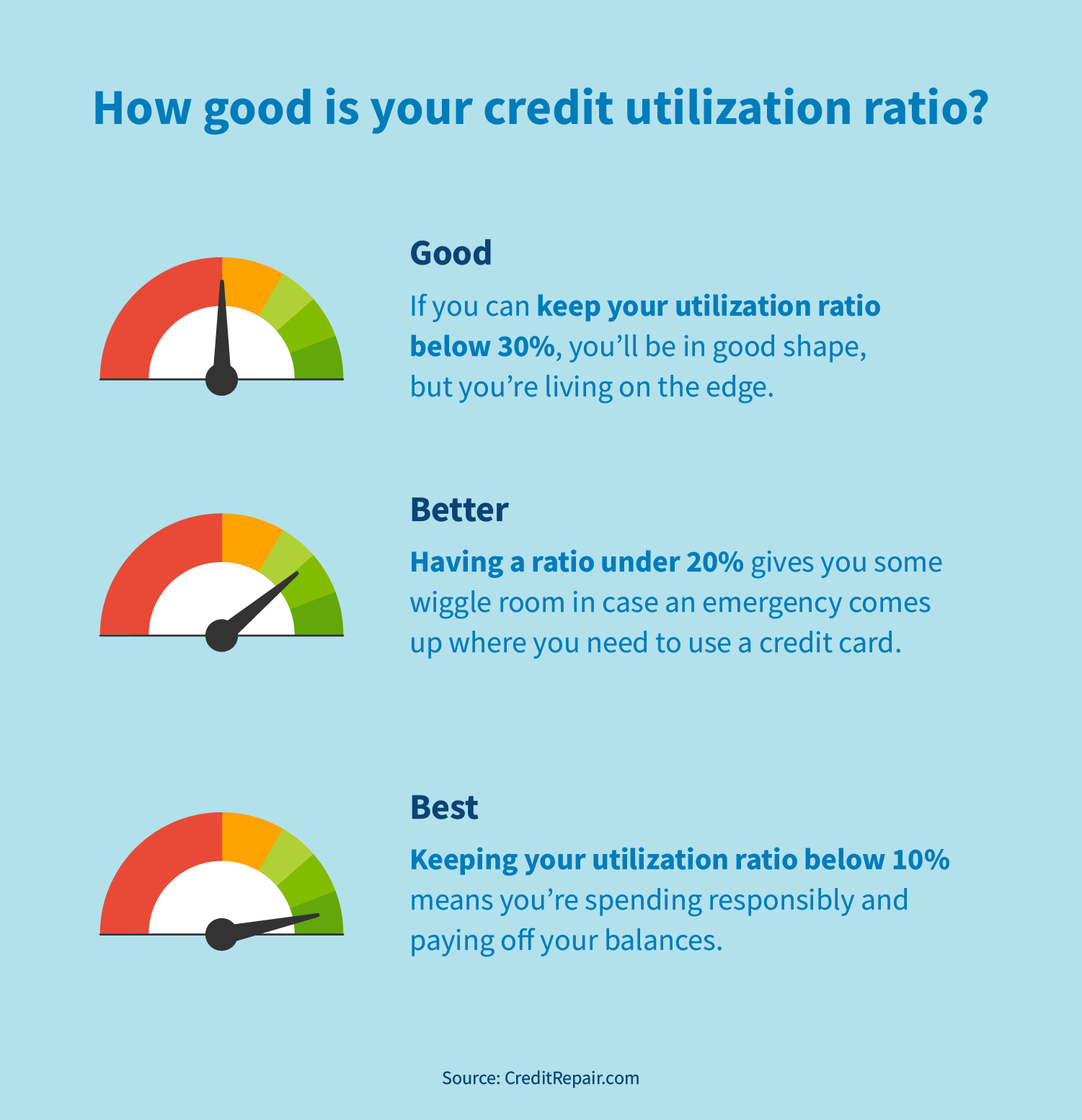

- Keep credit utilization below 30% (ideally under 10%)

- Do not close old accounts – Credit history length matters

- Avoid multiple credit applications at once

- Check your credit report regularly for errors

👉 Consistency is key. Small improvements over time lead to strong long-term results.

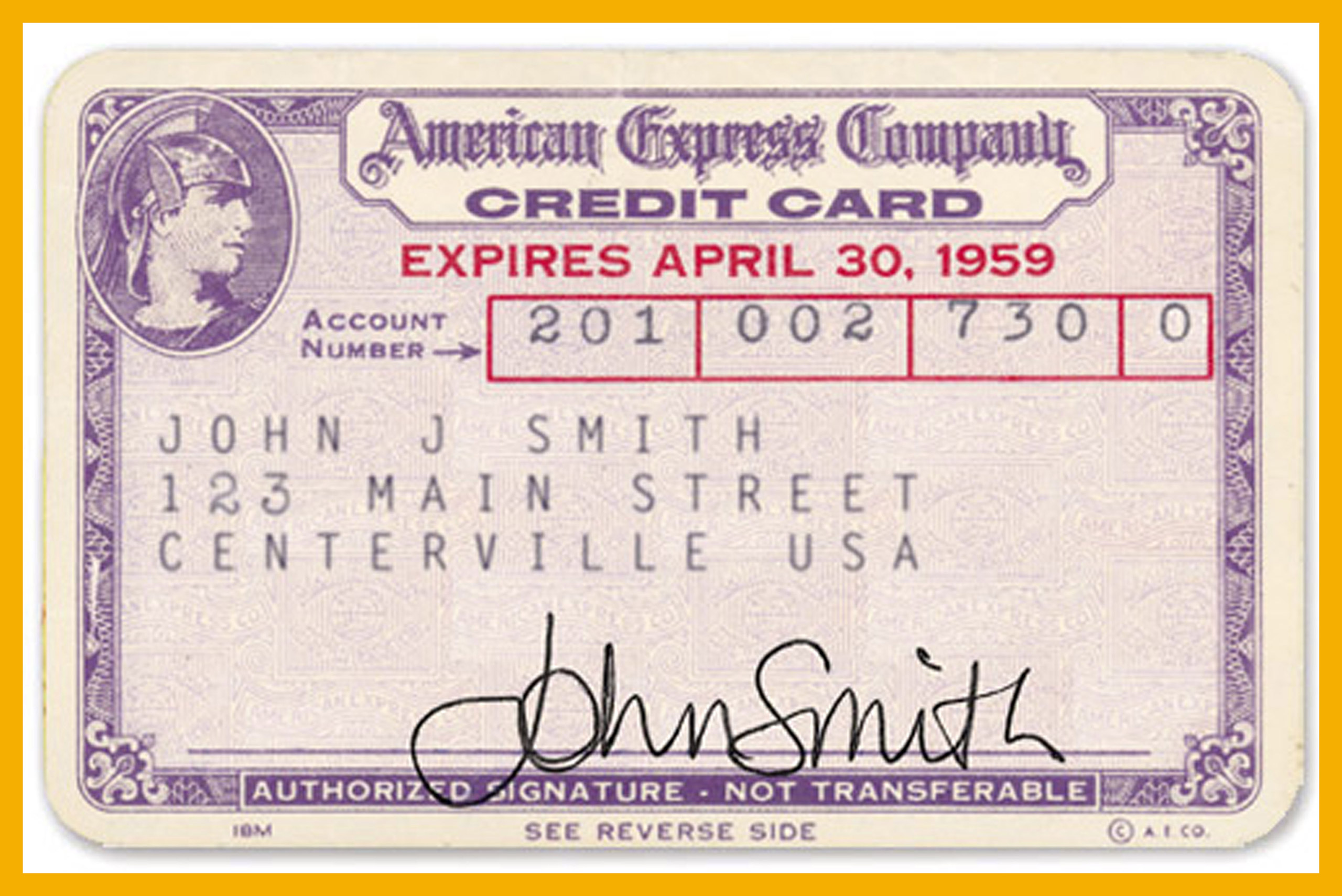

💳 Credit Cards for Beginners

Credit cards are one of the easiest ways to build credit in the U.S.—when used responsibly.

Good options for beginners:

- Secured credit cards – Require a refundable deposit

- Student credit cards – Designed for college students

- Starter unsecured cards – Low limits, simple terms

Best practices:

- Use the card for small purchases

- Pay the balance in full every month

- Never treat credit cards as extra income

👉 Used correctly, credit cards help build credit without creating debt.

💸 How to Get Out of Debt in the U.S.

Debt is common in the U.S., but it doesn’t have to be permanent. A clear strategy makes all the difference.

Step-by-step approach:

- List all debts (balance, interest rate, minimum payment)

- Choose a payoff method:

- Debt Snowball: Pay smallest balances first

- Debt Avalanche: Pay highest interest rates first

- Stop adding new debt

- Negotiate interest rates when possible

- Use extra income to accelerate payments

Avoid quick-fix promises. Sustainable debt freedom comes from discipline and planning.

✅ Final Thoughts

Understanding credit, managing debt, and building a strong credit score are foundational skills for financial success in the United States. With the right habits—on-time payments, controlled spending, and strategic use of credit—you can turn credit into a powerful financial tool instead of a burden.

Whether you’re just starting or rebuilding your credit, the most important step is to begin today.