Investing in the U.S. Financial Market

A Beginner’s Guide

Advertising

The United States has one of the largest and most accessible financial markets in the world. Whether your goal is to build long-term wealth or generate additional income, understanding how investing works in the U.S. is essential.

In this article, you’ll learn:

- How to start investing in the U.S. stock market

- Popular ETFs in the United States

- The difference between stocks, ETFs, and mutual funds

- Long-term investing vs. day trading

📈 How to Start Investing in the U.S. Stock Market

Getting started in the U.S. stock market is easier than many people think, especially with modern online brokerages.

Step 1: Open a Brokerage Account

Choose a U.S.-based brokerage that fits your needs. Many platforms offer:

- No commission trades

- Low minimum investment

- Easy-to-use apps

You’ll typically need:

- A Social Security Number (SSN) or ITIN

- A U.S. bank account

Step 2: Define Your Investment Goals

Before investing, ask yourself:

- Are you investing for retirement, a home, or long-term growth?

- What is your risk tolerance?

Your goals will determine your investment strategy.

Step 3: Start Small and Stay Consistent

You don’t need a large amount of money to begin. Consistent investing over time is more important than timing the market.

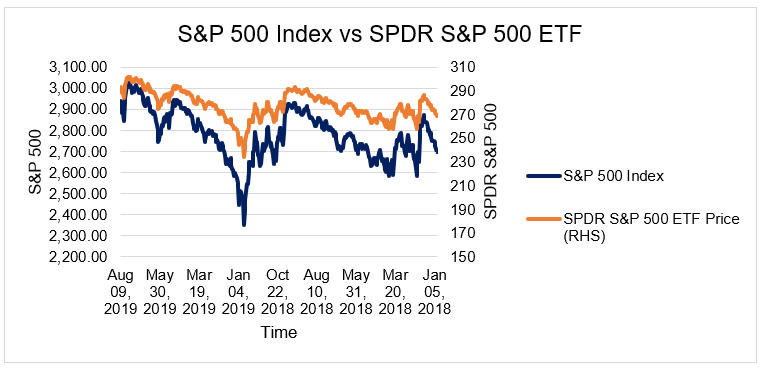

📊 Popular ETFs in the U.S. Market

ETFs (Exchange-Traded Funds) are among the most popular investment vehicles in the U.S. due to their simplicity and diversification.

Common U.S. ETFs:

- S&P 500 ETFs – Track the 500 largest U.S. companies

- Nasdaq-100 ETFs – Focus on technology and growth companies

- Total Market ETFs – Provide exposure to the entire U.S. stock market

- Bond ETFs – Add stability and income

ETFs are widely used by beginners and experienced investors alike.

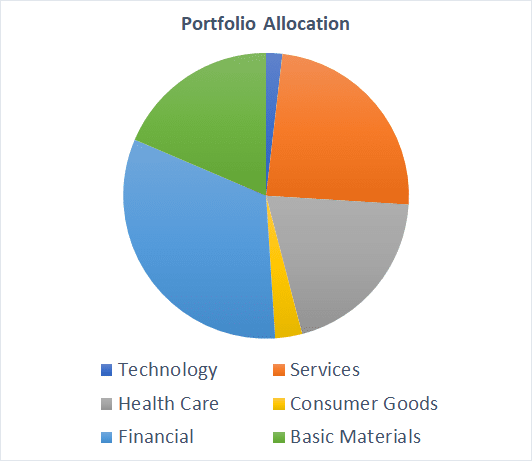

🔍 Stocks vs. ETFs vs. Mutual Funds

Understanding the differences between investment types helps you build a balanced portfolio.

Stocks

- Ownership in a single company

- Higher potential returns

- Higher volatility and risk

ETFs

- A collection of multiple assets

- Lower risk through diversification

- Traded like stocks during market hours

Mutual Funds

- Professionally managed portfolios

- Often higher fees

- Trades occur once per day

👉 ETFs are often preferred for their low cost, flexibility, and diversification.

⏳ Long-Term Investing vs. Day Trading

Investors often choose between long-term investing and day trading, but these strategies are very different.

Long-Term Investing

- Focus on years or decades

- Benefits from compound growth

- Lower stress and fewer transactions

- Historically proven to build wealth

Day Trading

- Buying and selling within the same day

- High risk and emotional pressure

- Requires experience, discipline, and constant monitoring

- Most beginners lose money

👉 For most investors, long-term investing is the safer and more effective strategy.

✅ Final Thoughts

The U.S. financial market offers countless opportunities, but success depends on education, discipline, and patience. Starting early, diversifying investments, and focusing on long-term goals are key principles for building wealth.

Whether you’re new to investing or refining your strategy, understanding how the market works is the first step toward financial independence.