Estate Planning and Wealth Transfer

Protecting Your Family and Your Financial Legacy

Estate planning is often misunderstood as something only wealthy families need. In reality, estate planning matters for anyone who owns assets, has dependents, or wants control over what happens to their money and property.

In the United States, failing to plan properly can lead to unnecessary taxes, legal delays, family conflict, and outcomes that don’t reflect your wishes. Thoughtful estate planning is not about death—it’s about protection, clarity, and peace of mind.

In this article, you’ll learn:

- Why estate planning matters—even for middle-income families

- The difference between wills and trusts

- How beneficiaries and asset transfers work

- Common estate planning mistakes to avoid

🏛️ Why Estate Planning Matters—even for Middle-Income Families

Many people delay estate planning because they believe their assets are “too small” to matter. This is one of the most common—and costly—misconceptions.

Estate planning is essential if you:

- Own a home

- Have savings or retirement accounts

- Have children or dependents

- Want to avoid court involvement (probate)

- Want to control who receives your assets

Without an estate plan, state laws—not you—decide how your assets are distributed. This process, known as intestate succession, may not reflect your wishes and can create delays and expenses for loved ones.

👉 Estate planning isn’t about wealth size—it’s about control and protection.

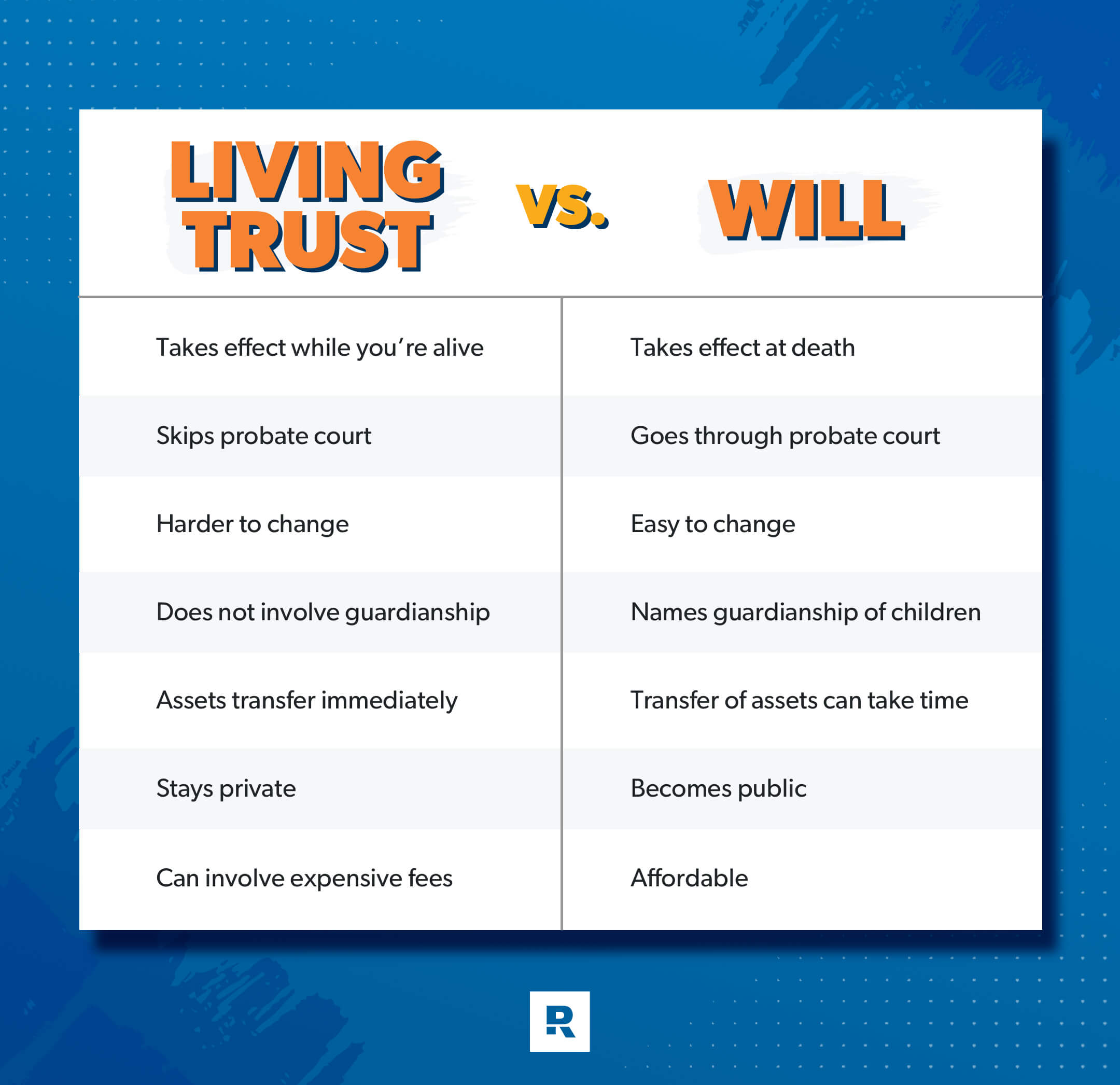

📜 Wills vs. Trusts: What’s the Difference?

Understanding the difference between wills and trusts helps you choose the right tools for your situation.

Wills

- A will is a legal document that:

- Specifies how your assets should be distributed after death

- Names guardians for minor children

- Takes effect only after death

Pros:

- Simple and affordable

- Covers guardianship decisions

Cons:

- Goes through probate

- Becomes public record

- Can be challenged in court

Trusts

A trust holds assets for beneficiaries and can take effect during your lifetime.

Pros:

- Avoids probate

- Provides privacy

- Allows more control over timing and conditions

- Can help in incapacity planning

Cons:

- More complex

- Higher upfront cost

👉 Many families use both: a trust for assets and a will for guardianship and backup instructions.

Also check out: Healthcare Costs and Medical Financial Planning in the U.S

👥 Beneficiaries and Asset Transfer

One of the most overlooked aspects of estate planning is beneficiary designations.

Assets that pass by beneficiary designation:

- 401(k)s and IRAs

- Life insurance policies

- Annuities

- Some bank and brokerage accounts

These assets do not follow your will—they transfer directly to the named beneficiary.

Best practices for beneficiaries:

- Review designations regularly

- Update after life events (marriage, divorce, births)

- Name contingent (backup) beneficiaries

- Ensure consistency across all documents

- 👉 An outdated beneficiary designation can override your entire estate plan.

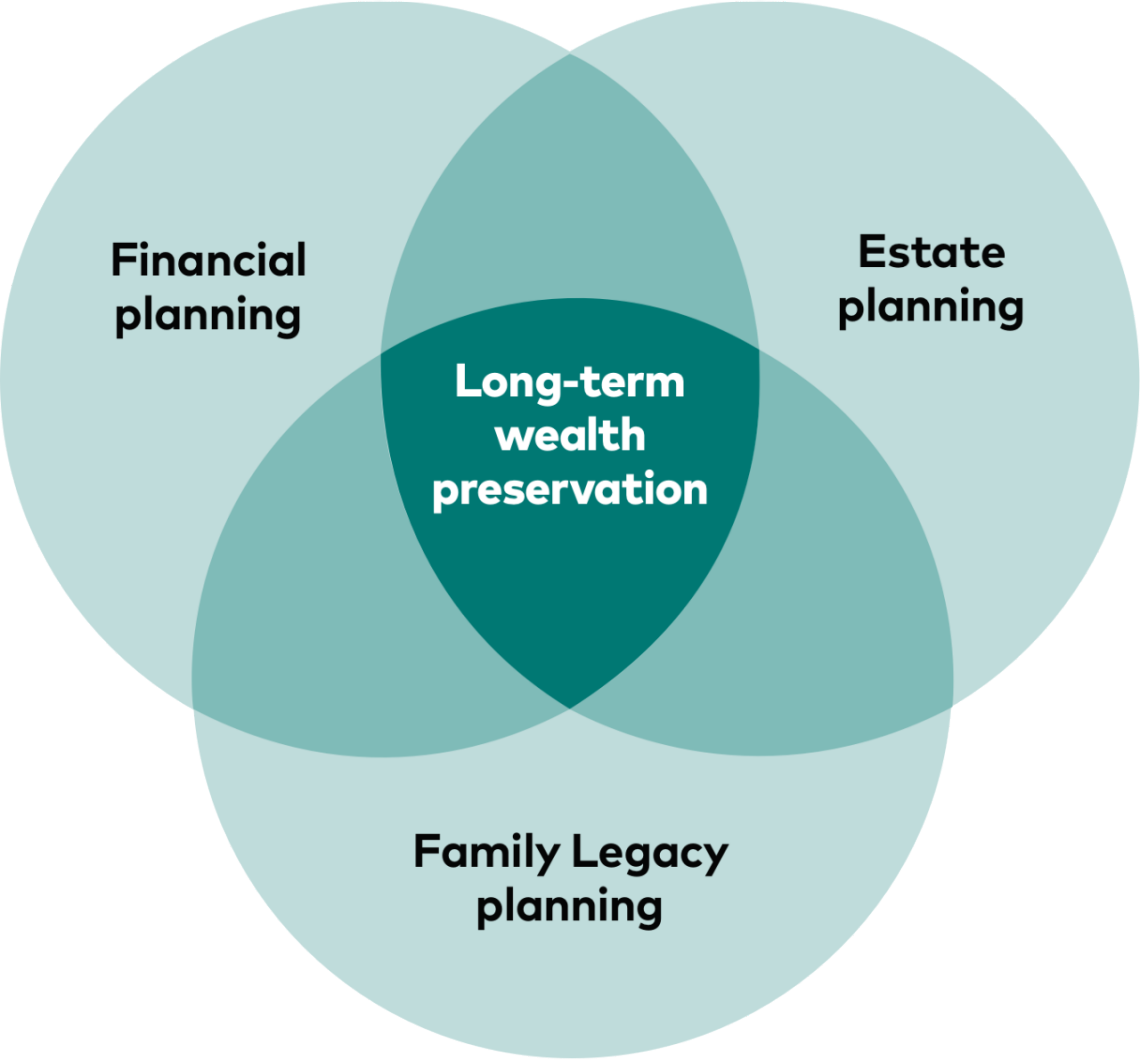

🧠 How Wealth Transfer Really Works

Wealth transfer is not just about distributing money—it’s about timing, taxes, and responsibility.

Key considerations:

- Should beneficiaries receive assets immediately or over time?

- Should minors receive assets through a trust?

- Should distributions be tied to milestones (age, education)?

- How will taxes affect heirs?

Proper planning can:

- Reduce estate taxes

- Protect assets from creditors

- Prevent misuse of inherited wealth

- Reduce family conflict

👉 Thoughtful wealth transfer planning is an act of responsibility, not control.

⚠️ Common Estate Planning Mistakes

Even well-intentioned families make mistakes that undermine their plans.

Common mistakes include:

❌ Not having any estate plan

❌ Failing to update documents

❌ Naming minors directly as beneficiaries

❌ Overlooking beneficiary designations

❌ Assuming a will avoids probate

❌ Ignoring incapacity planning

❌ DIY plans without legal review

👉 Estate planning is not “set it and forget it.” It should evolve with your life.

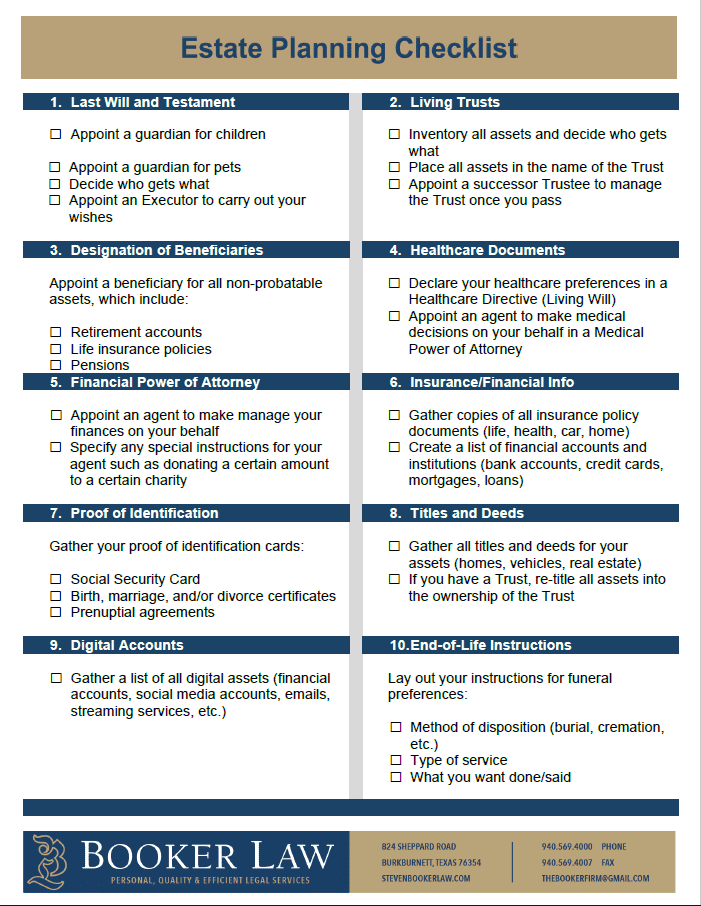

🧾 Estate Planning Beyond Death: Incapacity Planning

Estate planning also protects you while you’re alive.

Important documents include:

- Financial power of attorney – Who manages finances if you can’t

- Healthcare power of attorney – Who makes medical decisions

- Living will / advance directive – Your healthcare preferences

Without these documents, courts may appoint someone to make decisions on your behalf.

👉 Estate planning is about dignity, not just inheritance.

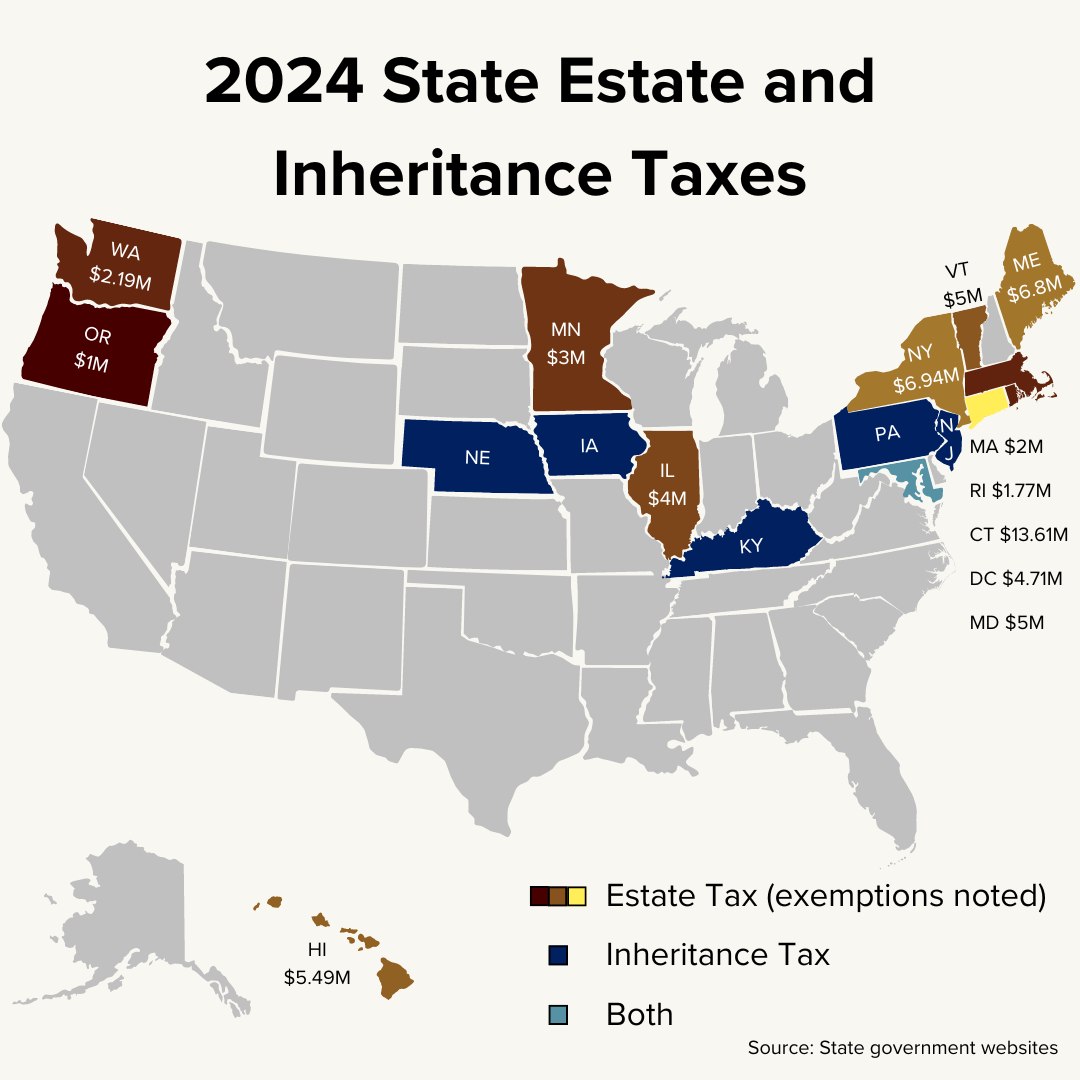

📊 Estate Planning and Taxes

Most middle-income families won’t owe federal estate tax, but planning still matters.

Why tax planning is still important:

- State estate or inheritance taxes may apply

- Retirement accounts have income tax implications

- Poor planning can increase tax burdens for heirs

Strategic planning can:

- Spread tax liability over time

- Protect tax-advantaged accounts

- Improve after-tax outcomes for beneficiaries

👉 Good estate planning focuses on net outcomes, not just asset values.

🛡️ Estate Planning as Financial Protection

A well-structured estate plan:

- Reduces stress for loved ones

- Prevents legal disputes

- Speeds up asset transfer

- Protects children and dependents

- Preserves family relationships

Estate planning is one of the most meaningful financial steps you can take—because it protects others when you no longer can.

✅ Final Thoughts

Estate planning is not only for the wealthy—it’s for the prepared. Whether you’re building wealth, raising a family, or planning for retirement, having a clear estate plan ensures your assets, values, and intentions are honored.

The cost of planning is almost always far less than the cost of not planning.

Estate planning isn’t about anticipating the end—it’s about protecting the people you care about most.