Credit Card HDFC Bank

If you are interested in acquiring an HDFC Bank card, then reading this post is mandatory. In the following sections, we will present the card options that this institution offers, exploring their advantages and disadvantages. Stay tuned!

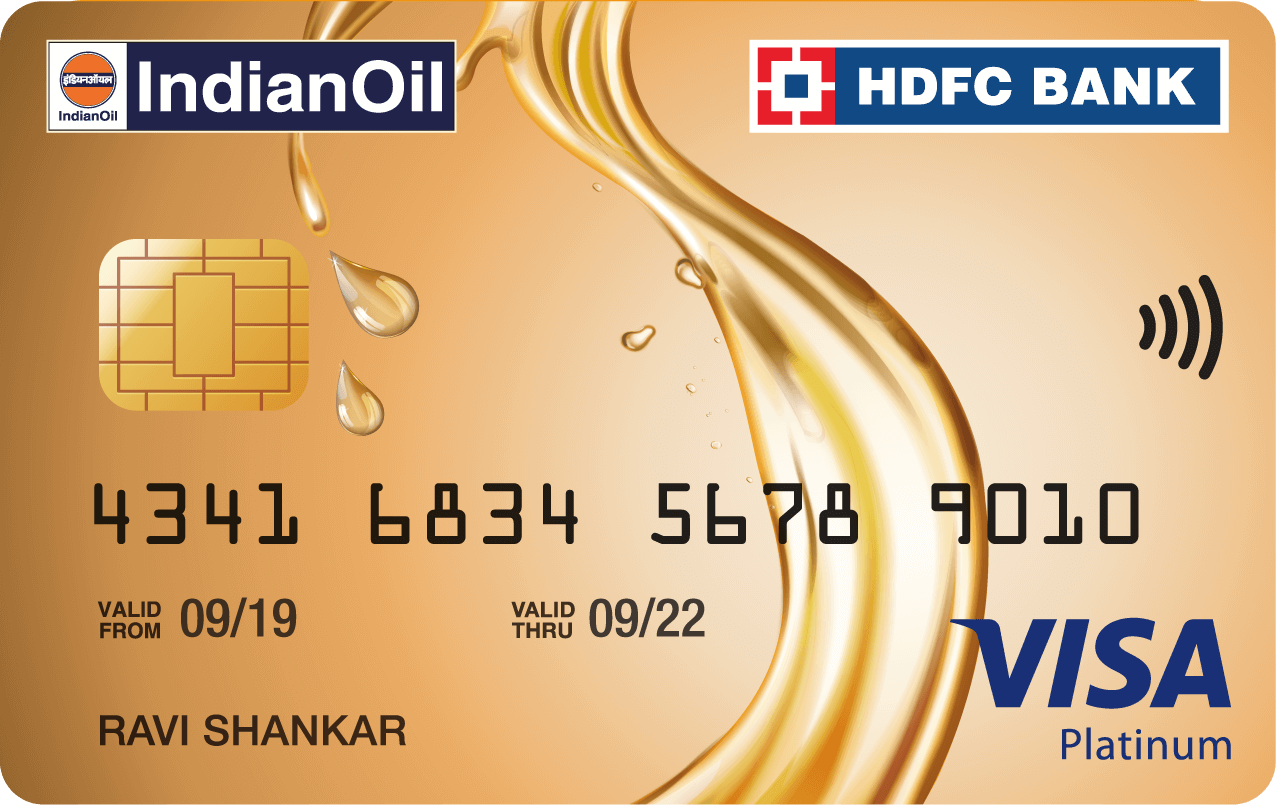

HDFC Bank Card

HDFC Bank is widely known for the services it provides to Indian citizens through digital means. The company is India’s #1 fintech and the first bank to operate 100% online through virtual platforms.

Among the bank’s main financial products, the highlight goes to the Bank card. To meet the needs of all its customers, the bank offers the product in different modalities, which are: Gold, Mastercard Standard SPFC, Platinum, Black, and the Mastercard Microbusiness card, targeted at SMEs and corporate clients.

General Advantages of Bank Card

- No annual fee;

- Requires only a minimum income corresponding to the minimum wage;

- Accepts contactless payment;

- International coverage;

- Cashback program;

- Offers unlimited services free of charge.

General Disadvantages of Bank Card

- There is a fee of INR 15 for the emergency credit evaluation;

- For the 2nd card issuance, the customer pays INR 15;

- No reward points program;

- Only one card network (Mastercard);

- A fee of INR 30 is charged for cash withdrawal at banking channels.

Annual Fee

Fortunately, all HDFC Bank cards are exempt from annual fees. This is due to the fact that the services associated with these cards are provided through the bank’s digital channels, significantly reducing their maintenance and operational costs.

Minimum Income Requirement

The minimum income required to apply for an HDFC Bank card is not excessive. The interested party only needs to have a monthly income that is not less than the current minimum wage to pass the bank’s internal credit assessment.

Network and Coverage

To provide the widest coverage possible to HDFC Bank credit cardholders, the bank opts to use the Mastercard network for all card variants. Therefore, customers can use the card for both domestic and international transactions.

Mobile App

Since HDFC Bank is a fintech, it couldn’t be without a dedicated app for managing the HDFC Bank card. All one needs is an Android or iOS smartphone to download the app from Google Play or App Store and have complete card management at their fingertips.

HDFC Bank Card Customer Support

HDFC Bank provides various customer support channels. By using the app, for example, customers can interact with the virtual assistant “Babi,” which helps with problem resolution and clarifying doubts. In addition to this channel, interested parties can also access support through the following options:

- Help Center on the website.

See Also: BANK OF AMERICA CREDIT CARD