Personal Finance Made Simple

A Practical Guide for Everyday Life

Advertising

Personal finance doesn’t need to be complicated, intimidating, or filled with technical jargon. For many people in the United States, money stress comes not from a lack of effort, but from a lack of clear, practical guidance. Schools rarely teach us how to budget, manage debt, or plan for the future — yet these skills shape nearly every part of our lives.

The good news is that you don’t need to be wealthy, perfect, or highly disciplined to improve your financial situation. You only need a few simple systems, realistic habits, and a basic understanding of how money works in everyday life.

This guide breaks down the foundations of personal finance in a way that is easy to understand and easy to apply, even if you’re starting from scratch.

How to Organize a Budget Even on a Low Income

One of the most common myths about budgeting is that it only works if you earn a lot of money. In reality, budgeting is most important when money is tight.

A budget is not about punishment or restriction. It’s about clarity. When you know exactly where your money is going, you can make better decisions — even with limited income.

Step 1: Start with your real income

Always use your net income, not your gross salary. This is the money that actually lands in your bank account after taxes and deductions.

If your income varies (freelance work, tips, hourly shifts), calculate a conservative monthly average based on the last 3–6 months.

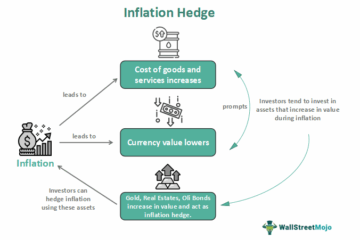

Also read the text: Inflation-Proofing Your Lifestyle

Step 2: List your expenses honestly

Break expenses into three categories:

- Fixed expenses: rent, utilities, insurance, minimum debt payments

- Variable expenses: groceries, gas, dining out, entertainment

- Irregular expenses: subscriptions, annual fees, gifts, car maintenance

Many people underestimate irregular expenses — but these are often what break a budget.

Step 3: Use a flexible budgeting framework

A modified version of the 50/30/20 rule works well for beginners:

- Needs: 50–60%

- Wants: 20–30%

- Savings and debt: at least 10%

If saving 10% feels impossible, start with $25 or $50 per month. The habit matters more than the amount.

Step 4: Automate when possible

Automatic bill payments and savings transfers reduce mistakes and remove emotional decision-making. Automation turns good intentions into consistent action.

Common Financial Mistakes That Hold People Back

Many financial struggles are caused not by income level, but by patterns we don’t notice — or don’t question.

Living without a plan

Spending without a plan often leads to relying on credit cards to fill the gaps. A simple plan gives your money direction and reduces stress.

Confusing wants with needs

Housing, food, utilities, and transportation are needs. Frequent upgrades, impulse purchases, and lifestyle inflation are wants — even if they feel necessary.

Learning the difference creates instant financial breathing room.

Ignoring small expenses

Daily coffee, delivery fees, and unused subscriptions don’t seem expensive individually, but together they can cost hundreds of dollars per month.

Tracking reveals these hidden leaks.

Waiting for a higher income to start

More income without better habits usually leads to more spending. Financial progress starts with behavior, not salary.

How to Get Out of Debt Step by Step

Debt can feel overwhelming, especially when balances grow faster than payments. The key is replacing fear with structure.

Step 1: Get the full picture

List every debt you have:

- Credit cards

- Personal loans

- Auto loans

- Medical bills

Include balances, interest rates, and minimum payments. Avoid judgment — this is information, not failure.

Step 2: Choose a payoff strategy

Two proven methods work well:

- Snowball method: Pay off the smallest balance first for motivation

- Avalanche method: Pay off the highest interest rate first to save money

The best method is the one you will actually follow.

Step 3: Stop adding new debt

Even small new charges slow progress. Pause non-essential spending and use cash or debit whenever possible.

Step 4: Use extra income intentionally

Tax refunds, bonuses, side income, or gifts should go toward debt until balances are manageable.

Debt freedom is not instant, but every payment reduces stress and increases options.

The Difference Between Spending, Saving, and Investing

Understanding how these three actions work together is essential for financial stability.

Spending

Spending covers your current life. It includes both needs and wants. The goal is not to eliminate spending, but to make it intentional and aligned with your priorities.

Saving

Saving protects you from emergencies and short-term goals, such as:

- Unexpected medical bills

- Car repairs

- Job loss

- Planned expenses like travel or moving

A good first goal is a $1,000 emergency fund, followed by 3–6 months of essential expenses.

Investing

Investing is for long-term growth. It allows your money to grow over time through compound interest.

Common investing tools include:

- Employer-sponsored retirement plans

- Individual retirement accounts

- Long-term diversified portfolios

Saving keeps you safe. Investing builds your future.

Building Financial Confidence Over Time

Personal finance is not about perfection. Everyone makes mistakes. The difference between staying stuck and moving forward is learning, adjusting, and continuing.

Start with one action:

- Track expenses for one month

- Save your first $100

- Pay off one small debt

- Cancel one unnecessary subscription

Small steps build confidence, and confidence leads to momentum.

Final Thoughts

You don’t need to overhaul your entire life to improve your finances. You need clarity, patience, and consistency. When you understand where your money goes and why, you gain control — regardless of income level.

Personal finance is a skill, not a talent. And like any skill, it improves with practice.

Start where you are. Progress will follow.