: Understanding Its Impact on Your Wallet and the Economy Today

Advertising

Inflation is a topic that impacts everyone’s finances directly. Understanding inflation is crucial for making informed financial decisions. In this post, we’ll explore the impact of inflation on our wallets and the economy. We will cover the causes, the effects on household budgets, and provide strategies to safeguard your finances. Let’s dive in!

What is Inflation and How Does It Work?

Inflation is defined as the general increase in prices of goods and services in an economy over time. This means that as inflation rises, the purchasing power of your money decreases, leading to what we call a decline in real value. For example, if inflation is at 3%, something that costs $100 today will cost $103 a year later, making it crucial for consumers to understand how it impacts their wallets.

How Does Inflation Work?

Inflation typically occurs due to increased demand for goods and services, which can outpace supply. When consumers want to buy more than what is available, prices tend to go up. Additionally, inflation can also arise from increases in production costs, including wages and raw materials. This concept is essential for understanding the cycle of economic growth and price stability.

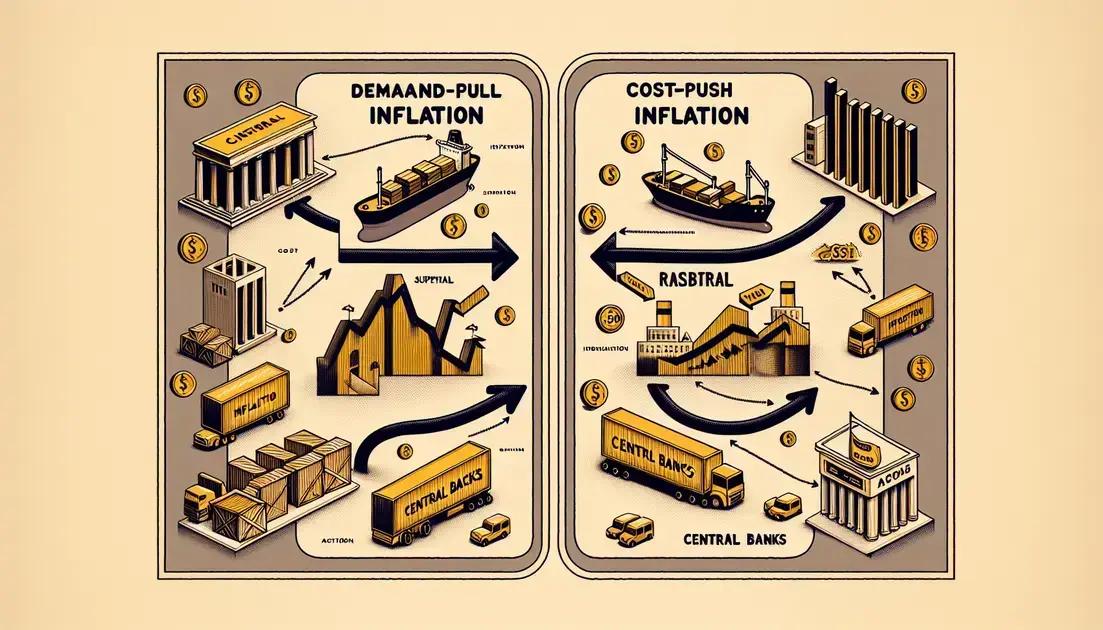

Types of Inflation

There are mainly three types of inflation: demand-pull inflation, cost-push inflation, and built-in inflation. Demand-pull inflation occurs when demand exceeds supply. Cost-push inflation happens when production costs rise and are passed on to consumers. Built-in inflation is when businesses raise prices to keep up with wage increases, creating a cycle of rising prices.

Measuring Inflation

Inflation is usually measured by looking at the Consumer Price Index (CPI) or the Producer Price Index (PPI). The CPI tracks changes in the price level of a basket of consumer goods and services. In contrast, the PPI measures the average change over time in the selling prices received by domestic producers for their output. These indices help policymakers make informed decisions about interest rates and economic policy.

The Reasons Behind Rising Inflation Rates

Several factors contribute to the rising rates of inflation. One primary reason is increased consumer demand. When people feel confident about the economy, they tend to spend more. This higher demand for goods and services can push prices up. This phenomenon is known as demand-pull inflation.

Supply Chain Disruptions

Another significant driver of inflation is supply chain disruptions. Issues such as natural disasters, global pandemics, and geopolitical tensions can affect the supply of goods. When supply decreases, prices usually increase as consumers compete for the limited availability of products.

Rising Production Costs

Inflation can also be caused by rising production costs. When the costs of raw materials and labor increase, manufacturers may pass these costs onto consumers in the form of higher prices. This is referred to as cost-push inflation, and it plays a crucial role in the overall inflation rate.

Monetary Policy Decisions

The actions of central banks, such as the Federal Reserve in the United States, can significantly influence inflation. When banks lower interest rates, borrowing becomes cheaper, encouraging spending and investment. While this can stimulate economic growth, it may also contribute to higher inflation rates if not managed carefully.

Lastly, policies and regulations that affect the economy can also impact inflation rates. For example, changes in taxes or government spending can alter demand levels, leading to fluctuations in prices.

Effects of Inflation on Household Budgets

The effects of inflation on household budgets can be significant and wide-reaching. As prices for goods and services rise, families find their purchasing power declines. This means that the same amount of money buys fewer items than before, forcing households to adjust their spending habits.

Higher Costs of Essentials

One of the most immediate effects of inflation is seen in the rising costs of essential goods like food, gas, and housing. Families may notice that their grocery bills increase, and filling up the car becomes more expensive. These higher costs can strain budgets, pushing households to reconsider their spending priorities.

Reduced Discretionary Spending

As prices rise, household budgets may become tighter, leading to reduced discretionary spending. Families might cut back on non-essential items like dining out, entertainment, and vacations. This shift can affect local businesses that rely on consumer spending for their profits.

Adjustments in Saving and Investment

Inflation also impacts how households save and invest. With money losing value over time, families may need to re-evaluate their saving strategies. They might seek investments that offer higher returns to outpace inflation, but these options can come with increased risks.

Rising Interest Rates

In response to inflation, central banks might raise interest rates to stabilize the economy. Higher borrowing costs can further limit household budgets as loans and credit become more expensive. Mortgages, car loans, and credit card interest rates may rise, creating additional financial pressure.

Overall, understanding how inflation affects household budgets is crucial for families making financial decisions. Awareness of these impacts can help households better manage their finances in an inflationary environment.

Strategies to Protect Your Finances from Inflation

Protecting your finances from inflation requires strategic planning and smart decision-making. Here are several effective strategies that can help you safeguard your money.

Diversify Your Investments

One key strategy is to diversify your investments. Instead of putting all your money into one type of asset, consider mixing stocks, bonds, real estate, and commodities. This helps spread risk, and some of these investments, like real estate and precious metals, can hold their value during inflationary periods.

Invest in Stocks

Historically, stocks have outpaced inflation over the long term. By investing in companies with strong growth potential, you can potentially earn returns that exceed inflation rates. Look for businesses with solid fundamentals and competitive advantages that can maintain profitability during economic changes.

Consider Inflation-Protected Securities

Another option is to invest in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS). These government-backed bonds adjust with inflation, allowing you to earn a fixed interest rate plus inflation adjustment. This can help preserve your purchasing power.

Adjust Your Budget

Review your household budget regularly to identify areas where you can cut back on spending. Focus on discretionary expenses that can be reduced without affecting your quality of life. By freeing up funds, you can increase your savings or redirect money towards investments that help combat inflation.

Build an Emergency Fund

Having an emergency fund is crucial. Aim to save at least three to six months’ worth of expenses in a savings account. This fund can help you manage unexpected costs without the need to rely on debt, which can be more expensive during times of inflation.

By employing these strategies, you can better prepare your finances to withstand the impacts of inflation.

Wrapping Up: Understanding Inflation and Its Impact

Inflation is a crucial factor that affects every aspect of our lives, from the prices we pay for basic goods to how we manage our finances. Understanding what inflation is and how it works helps us navigate its challenges.

In recognizing the reasons behind rising inflation rates, we prepare ourselves to anticipate its effects on household budgets. By realizing the impact on essential spending and overall financial health, families can take proactive measures.

Implementing effective strategies is key to protecting your finances from the erosive effects of inflation. From diversifying investments to adjusting budgets and building emergency funds, being financially savvy equips us to face economic uncertainty confidently.

In conclusion, education and action are our best tools in combating inflation, ensuring that our financial well-being remains secure in changing economic climates.