Healthcare Costs and Medical Financial Planning in the U.S

How to Protect Your Finances From Medical Expenses Healthcare is one of the most unpredictable—and expensive—parts of personal finance in the United States. Even people…

How to Protect Your Finances From Medical Expenses Healthcare is one of the most unpredictable—and expensive—parts of personal finance in the United States. Even people…

Building a Stronger Money Partnership Money is one of the most common sources of tension in relationships—but it can also be one of the strongest…

How to Protect and Grow Your Wealth Earning a high income in the United States creates opportunity—but it also creates complexity. As income rises, taxes…

How to Budget Smarter Where You Live Housing is the largest expense for most households in the United States. Whether you rent or own, where…

How to Use Debt Without Letting It Control Your Life Debt is a normal part of financial life in the United States. Mortgages, student loans,…

How to Protect Your Finances When Life Happens Financial emergencies don’t come with warnings. A job loss, medical bill, car repair, or unexpected move can…

How to Manage Money Through Every Phase of Life Personal finance isn’t static—your priorities, risks, and goals evolve as your life changes. What makes sense…

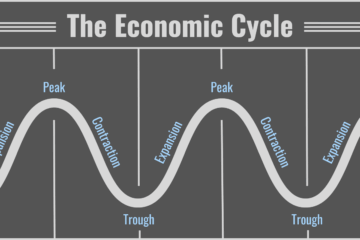

How They Impact Your Money Inflation, interest rates, and economic cycles affect everyone—whether you’re paying rent, saving money, investing, or carrying debt. While these concepts…

A Simple Guide to Getting Started Investing is one of the most effective ways to build wealth over time—but for beginners, it can feel overwhelming….

How to Earn Benefits Without Going Into Debt Credit cards are one of the most powerful—and misunderstood—financial tools in the United States. Used correctly, they…